Long Term Care (LTC) Statistics, Costs & Details

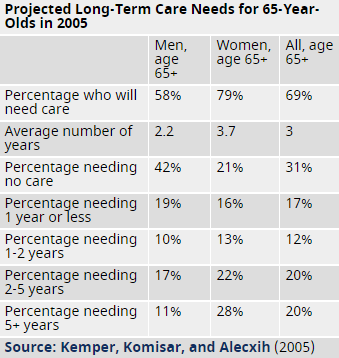

The next 15 years will have the Baby Boomer generation retiring at a growing rate. These retirees may not have a financial plan to take care of themselves should they need long term medical care.

|

Long Term Care (LTC) is typically defined as services someone needs to meet their daily personal needs. Most long term care is not medical care but rather assistance with the Activities of Daily Living (ADL's) such as:

Not to mention important tasks as taking medication, household chores and cooking meals. |

Medicare and Medicaid

Skilled Nursing:

Medicare does not pay the largest part of long-term care services or personal care—such as help with bathing, or for supervision often called custodial care. Medicare will help pay for a short stay in a skilled nursing facility, for hospice care, or for home health care if you meet the following conditions:

Medicare does not pay the largest part of long-term care services or personal care—such as help with bathing, or for supervision often called custodial care. Medicare will help pay for a short stay in a skilled nursing facility, for hospice care, or for home health care if you meet the following conditions:

- You have had a recent prior hospital stay of at least three days

- You are admitted to a Medicare-certified nursing facility within 30 days of your prior hospital stay

- You need skilled care, such as skilled nursing services, physical therapy, or other types of therapy

If you meet all these conditions, Medicare will pay for some of your costs for up to 100 days. For the first 20 days, Medicare pays 100 percent of your costs. For days 21 through 100, you pay your own expenses up to $140.00 per day (as of 2013), and Medicare pays any balance.

You pay 100 percent of costs for each day you stay in a skilled nursing facility after day 100.

You pay 100 percent of costs for each day you stay in a skilled nursing facility after day 100.

Medicare only covers other long term care needs to varying limiting degrees which you can get more information about by visiting here.

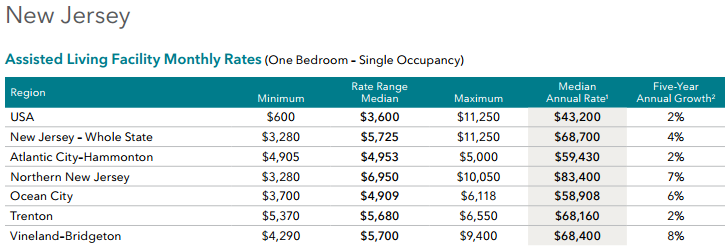

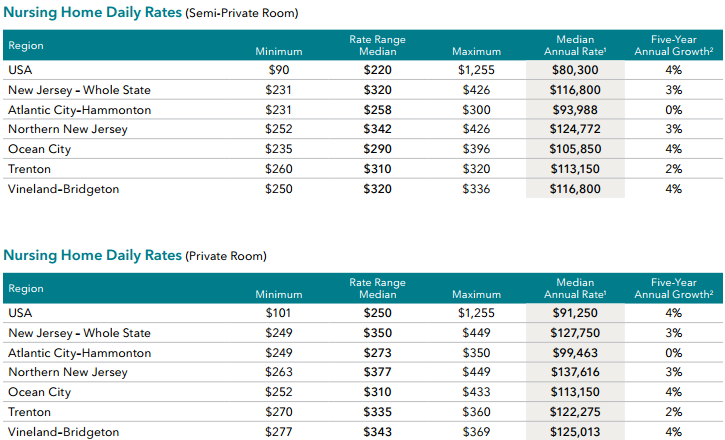

Assisted Living & Nursing Home Average Costs

Paying up to $5,000 a month for long term care can wipe out your savings quickly.

The younger you decide to get a good policy, the lower your premiums will be with more benefit protection.

The younger you decide to get a good policy, the lower your premiums will be with more benefit protection.

The advice I give the people I meet is to consider an asset based long term care policy, pay what you can handle comfortably and let the benefits of your policy do the heavy lifting when it comes to paying for long term care.

As you will soon see from the benefit policies I promote, if you never need long term care, the increased cash value benefit can remain with you or can be left with any beneficiary you prefer such as your children when you are no longer around.

Hopefully you will never need long term medical care for the rest of your life which is why you should have a strategic advantage in how you pay for the possibility of such care.

The San Diego Union-Tribune covers what can happen if you aren't financially prepared for sudden long term care costs, the couple featured in this story lost their savings of $100,000 paying for 5 years of long term care for Claire Raymond, 82, at the time of

this article.

As you will soon see from the benefit policies I promote, if you never need long term care, the increased cash value benefit can remain with you or can be left with any beneficiary you prefer such as your children when you are no longer around.

Hopefully you will never need long term medical care for the rest of your life which is why you should have a strategic advantage in how you pay for the possibility of such care.

The San Diego Union-Tribune covers what can happen if you aren't financially prepared for sudden long term care costs, the couple featured in this story lost their savings of $100,000 paying for 5 years of long term care for Claire Raymond, 82, at the time of

this article.

Protect Yourself Financially

One America's Asset-Care helps you plan for your future and protect your retirement with:

- Premiums to fit your budget. You can pay all at once, over 10 years, over 20 years or over your lifetime to suit your budget.

- Income-tax free benefits to help pay for your home health care, extended care, nursing home stays and more.

- Single and joint life coverage to cost effectively cover two people.

Different than traditional long-term care insurance

Unlike traditional LTC insurance, OneAmerica offers:

- Premiums guaranteed to never increase, ensuring your peace of mind.

- A guaranteed death benefit for your loved ones if LTC is never needed.

- Guaranteed cash value growth, returned to you if you choose.

- Optional lifetime LTC benefits.

For Annual Pay

If you have trouble viewing document above you can download the same document file below

| i-18686_assetcare1_annualpayflier_final_063015.pdf |

For a Single Premium

If you are interest in paying a 1 time only premium, it is possible to transfer other assets you may have like a CD or IRA. This can be an advantage to you because with rates on CD's so low right now you can get much better value for your dollar with tax protection if you were to place some money from a CD to a single premium asset based policy such as One America's Asset Care

For More Information & Quote Rates...

Contact:

Ricky Moore

888-641-1127

914-223-3392 (Cell #)

ricky@healthyassets.org

Ricky Moore

888-641-1127

914-223-3392 (Cell #)

ricky@healthyassets.org