Why Would a Bank Put Money into Your Life Insurance Policy?

The Answer:

Banks understand the time tested cash growth value that life insurance policies steadily provide year after year for over a century.

Banks use life insurance policies as a safe place to go to when it comes to getting steady growth for their funds.

'Whole life, universal life and indexed universal life have traditionally maintained their values through tough economic times because they are designed with that very goal in mind.'

Banks know this and they put money into life insurance policies because they are securing their cash to reliably receive more cash from a life insurance company.

'Whole life, universal life and indexed universal life have traditionally maintained their values through tough economic times because they are designed with that very goal in mind.'

Banks know this and they put money into life insurance policies because they are securing their cash to reliably receive more cash from a life insurance company.

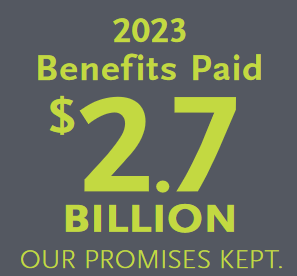

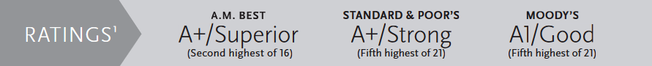

Banks are attracted to the Billions of Assets that a Life Insurance Company has Backing Up their Policies...

|

this is why you do not have to go through a credit check or be approved for a loan for your Kai-Zen policy to be funded by a bank.

No matter how rich you are, a bank has so much trust in the billions of dollars managed with a life insurance company that they are not looking to have your personal collateral at risk. The only thing you need to do is just pay your premiums for 5 years,(a bank will match your premiums for the first 5 years) watch as a bank continues to provide funds into your policy for another 5 years. |

Be patient and let your policy increase the size of your cash benefits for you to live on throughout your retirement.

Even after the bank gets their loan payment back plus interest from the policy's cash value benefit, you will still have 60% to 100% more retirement income than if you didn't pay those premiums for the first 5 years.