Here is How a Kai-Zen Policy Helps You

When I do a retirement analysis for my clients, they quickly see what kind of retirement their current spending and savings habits will create for them.

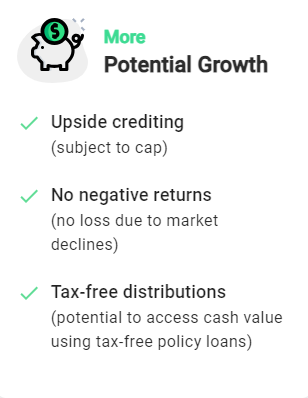

A Kai-Zen policy helps people that got off to a late savings start because this policy offers you up to 3 times more money than if you did not have a policy with them.

A Kai-Zen policy helps people that got off to a late savings start because this policy offers you up to 3 times more money than if you did not have a policy with them.