Do Not Lose Your Life Savings Paying for Potential Long

Term Care & Keep Your Savings If You Never Need Long

Term Care

Maybe you've heard a story from a friend or loved one that lost their savings paying for medical care.

According to a 2019 CNBC article, 66.5% of bankruptcies were tied to medical reasons.

We all know healthcare is expensive but there is a way to not only protect your savings, you can increase your savings as well.

This increase in your savings can pay for monthly long term care expenses should you need long term care, better yet, your increased savings can stay with you and your family if you never need long term care in your life, and hopefully you never will!

According to a 2019 CNBC article, 66.5% of bankruptcies were tied to medical reasons.

We all know healthcare is expensive but there is a way to not only protect your savings, you can increase your savings as well.

This increase in your savings can pay for monthly long term care expenses should you need long term care, better yet, your increased savings can stay with you and your family if you never need long term care in your life, and hopefully you never will!

'Like so many older Americans, the Raymonds have seen their life savings swallowed up by long-term care. It took the couple decades to turn their modest salaries into a $100,000 nest egg and just five years to completely deplete it after Claire moved into an assisted living facility.'

It is sad to hear stories of people having to spend all of their life savings within a short time paying for medical care.

Usually, when their life savings are spent, people must depend on either their family or try to qualify for medicaid to continue to receive long term care.

It is sad to hear stories of people having to spend all of their life savings within a short time paying for medical care.

Usually, when their life savings are spent, people must depend on either their family or try to qualify for medicaid to continue to receive long term care.

You Can Save More So You Don't Have to

Worry About Paying For Long Term Care

Needs

OneAmerica's Asset Care

What Does a OneAmerica Asset Care

Policy Cover for You?

Simply Put...

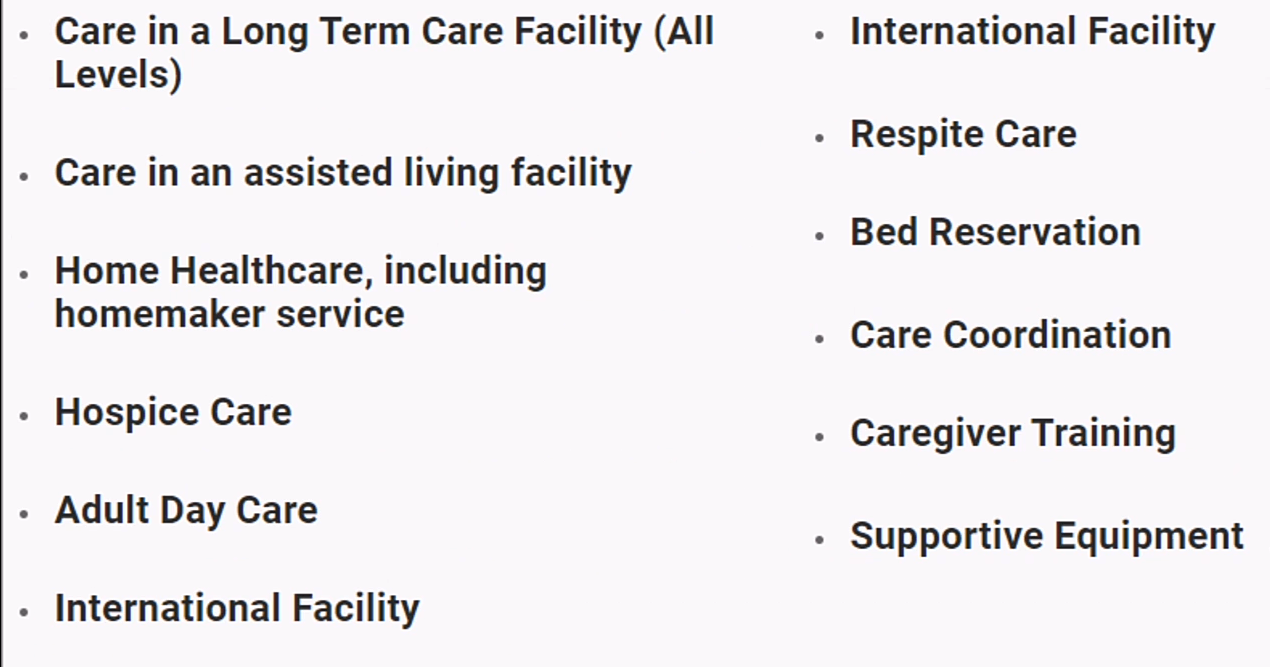

the average cost of all long term care services (assisted living, nursing home, in-home care) in America is about $5,900 a month. ($70,800 Annually)

If a 45 year old, non-smoking male, paid a once a year premium of $5,900 for just 20 years for an Asset Care policy instead of spending $5,900 a month for LTC services then his Asset Care Policy benefit would be:

$200,339 and this benefit would pay:

$8,014 monthly for the Long Term Care Services shown above for just over 2 years (25 months), even longer if his monthly long term care expenses are less than $8,014 a month.

There is a 33 month, a 50 month and lifetime long term care service payment options available for slightly higher premiums.

If a 45 year old, non-smoking female paid the same $5,900 annual premium for just 20 years then her benefit would be:

$214,467 and this benefit would pay:

$8,579 monthly for the Long Term Care Services shown above for just over 2 years (25 Months), again, even longer if her monthly long term care expenses are less that $8,014 a month.

If a 45 year old, non-smoking male, paid a once a year premium of $5,900 for just 20 years for an Asset Care policy instead of spending $5,900 a month for LTC services then his Asset Care Policy benefit would be:

$200,339 and this benefit would pay:

$8,014 monthly for the Long Term Care Services shown above for just over 2 years (25 months), even longer if his monthly long term care expenses are less than $8,014 a month.

There is a 33 month, a 50 month and lifetime long term care service payment options available for slightly higher premiums.

If a 45 year old, non-smoking female paid the same $5,900 annual premium for just 20 years then her benefit would be:

$214,467 and this benefit would pay:

$8,579 monthly for the Long Term Care Services shown above for just over 2 years (25 Months), again, even longer if her monthly long term care expenses are less that $8,014 a month.

Even though the Premiums are only paid annually for 20 years in this example...

This 45 year old male would stop paying premiums immediately after the year he turns 65 but his $200,339 will always be available for him and his family.

Just like the cash benefit of $214,467 would be there for a 45 year old female and her family or beneficiary of his/her choice.

In this quote example, you can save over $60,000 a year for every year you receive long term care services.

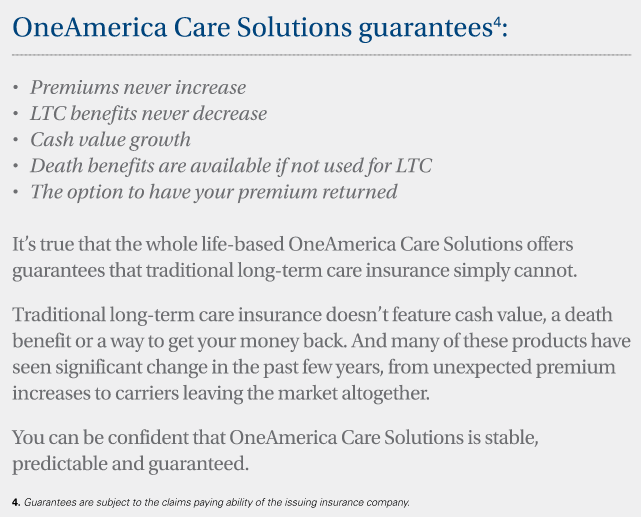

With a OneAmerica Asset Care Policy you can receive your benefits by paying either a monthly, quarterly, bi-annually, annually or you can just pay one premium with a Single Premium Policy that has a Return of Premium option*

The cash benefit stays with if you never need to use it for long term care and you can take out a loan against your cash benefit for any reason that you want, like home remodeling, or a family emergency!

The cash benefit stays with if you never need to use it for long term care and you can take out a loan against your cash benefit for any reason that you want, like home remodeling, or a family emergency!

The OneAmerica Asset Care Policy is a Great Way to Receive Financial Protection Especially if you Decide to get a Policy from the Ages of 35 to 55

To Receive a Quote Fill out the Form Below or Call or Text me, Ricky Moore at 240-644-4376.

Mutual of Omaha's MutualCare Custom

Solution Sample Quote

|

As the name implies, MutualCare Custom can be uniquely customized to fit your savings and spending goals when it comes to long term care expenses.

For instance, where most policies have a customary 30, 60 or 90 elimination period (the time you have to wait for your benefits to be given to you), MutualCare offers a 0 day elimination period meaning your policy benefits for long term care services are available right away. For other benefit examples please read the MutualCare Brochure below: |