Below are links to stories that highlight how important it is for you to do your own due diligence when your financial health and wealth is concerned.

OxyContin drug maker pleads guilty to fraud, for starters.

But will the profit seeking over health protection ever stop with top drug companies? -- Oct. 21, 2020

Yet another example of a drug company putting profits before their customer's health:

'...the Purdue Pharma settlement highlights how, for more than two decades, the widespread problem of overprescribing, diverting and abusing pain pills raged across America while drug manufacturers, distributors, pharmacists and doctors profited from the problem and largely deflected responsibility.'

'...the Purdue Pharma settlement highlights how, for more than two decades, the widespread problem of overprescribing, diverting and abusing pain pills raged across America while drug manufacturers, distributors, pharmacists and doctors profited from the problem and largely deflected responsibility.'

Due diligence is vital, especially when it comes to healthcare choices. There are just too many agendas that big pharma and greedy doctors have that has nothing to do with your health. Make sure you have a doctor that you can ask all the questions you want regarding what is being prescribed to you. Pros/Cons of an RX. Research clinical studies done on the medication and ask your doctor more questions if needed.

-- Ricky Moore

-- Ricky Moore

Why a Patient Paid a $285 Copay for a $40 Drug? -- Aug. 19, 2018

Looking at the transactional relationship between patients and pharmacies, pharmacies and PBM's (Pharmacy Benefit Managers) and PBM's and drug companies, it becomes a little more clear why medication costs and copays are are becoming more expensive.

Simply put 'healthcare is an industry where there are a lot of different parties that bring themselves involved with and in between the doctor/patient relationship. This video above does a decent job explaining why insurance copays for medication can often times be more money that the actual medication itself if the patient paid out of pocket with no insurance involved.

Why should a PBM choose which medications a patient can choose from?

Why are some medications favored by PBMs over others?

Does an increased profit factor in how a PBM decides which medication can be marketed to patients/customers?

You will notice the questions I am asking has nothing to do with what is best for the patient's health. Instead it is more of a game of negotiations between which party (PBM, Pharmacy or Drug Company) can get the dominant share of the profit even if prices are increased for no other reason than to get a bigger profit share.

--Ricky Moore

Simply put 'healthcare is an industry where there are a lot of different parties that bring themselves involved with and in between the doctor/patient relationship. This video above does a decent job explaining why insurance copays for medication can often times be more money that the actual medication itself if the patient paid out of pocket with no insurance involved.

Why should a PBM choose which medications a patient can choose from?

Why are some medications favored by PBMs over others?

Does an increased profit factor in how a PBM decides which medication can be marketed to patients/customers?

You will notice the questions I am asking has nothing to do with what is best for the patient's health. Instead it is more of a game of negotiations between which party (PBM, Pharmacy or Drug Company) can get the dominant share of the profit even if prices are increased for no other reason than to get a bigger profit share.

--Ricky Moore

A New York Union's Pension Goes Belly Up

NEWSMAX.com--Mar. 2, 2017

Back in December of last year I wrote an article called The Pension Wake Up Call which highlighted the pension drama of Chicago's Police & Firefighter retirees and forewarned of more pension bankruptcy issues to come.

Sadly, the NY Daily News covers a new case detailing the first pension fund to officially bottom out:

“I had a union job for 30 years,” Chmil said. “We had collectively bargained contracts that promised us a pension. I paid into it with every paycheck. Everyone told us, ‘Don’t worry, you have a union job, your pension is guaranteed.’ Well, so much for that.”

As I went over in The Pension Wake Up Call, it is time to stop blindly trusting what financial advisers tell us. Investments don't just magically produce a high return year after year. For this to occur there has to be real world, visible reasons that make high returns possible.

The sad fact is that most people don't even look at a detailed report that shows where their funds are invested in. That is a problem as the Chicago Police and Fireman and the New York Trucker Retirees can now tell you about.

What is a 'Pension Plan'

A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement.

In addition to an employer's required contributions, some pension plans have a voluntary investment component. A pension plan may allow a worker to contribute part of his current income from wages into an investment plan to help fund retirement. The employer may also match a portion of the worker’s annual contributions, up to a specific percentage or dollar amount.

-- From Investopedia.com

So now the questions to ask are:

Bottom Line: Apply due diligence in every big financial decision you make.

--Ricky Moore

Sadly, the NY Daily News covers a new case detailing the first pension fund to officially bottom out:

“I had a union job for 30 years,” Chmil said. “We had collectively bargained contracts that promised us a pension. I paid into it with every paycheck. Everyone told us, ‘Don’t worry, you have a union job, your pension is guaranteed.’ Well, so much for that.”

As I went over in The Pension Wake Up Call, it is time to stop blindly trusting what financial advisers tell us. Investments don't just magically produce a high return year after year. For this to occur there has to be real world, visible reasons that make high returns possible.

The sad fact is that most people don't even look at a detailed report that shows where their funds are invested in. That is a problem as the Chicago Police and Fireman and the New York Trucker Retirees can now tell you about.

What is a 'Pension Plan'

A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit. The pool of funds is invested on the employee's behalf, and the earnings on the investments generate income to the worker upon retirement.

In addition to an employer's required contributions, some pension plans have a voluntary investment component. A pension plan may allow a worker to contribute part of his current income from wages into an investment plan to help fund retirement. The employer may also match a portion of the worker’s annual contributions, up to a specific percentage or dollar amount.

-- From Investopedia.com

So now the questions to ask are:

- What markets can a pension invest in to get the high returns that are always promised?

- Have I done enough research into the financial advisers suggesting pension options to me?

- Are there options that I would consider better and safer for my situation?

Bottom Line: Apply due diligence in every big financial decision you make.

--Ricky Moore

Americans Spend More Than They Earn For 9th Straight Month As Savings Rate Tumbles To 2015 Lows

ZeroHedge--Jan. 30, 2017

The debt cycle continues. The road to a healthy economy isn't built by spending more than we earn.

Higher savings rates would be a nice start, more importantly, a financial system built on production instead of debt and consumption. Let's not over-regulate small businesses, Let Wall Street and banks stand on their own 2 feet without direct or indirect intervention from the Federal Reserve.

--Ricky Moore

Higher savings rates would be a nice start, more importantly, a financial system built on production instead of debt and consumption. Let's not over-regulate small businesses, Let Wall Street and banks stand on their own 2 feet without direct or indirect intervention from the Federal Reserve.

--Ricky Moore

Homeowners Should Tap Into Equity To Boost Consumer Spending -- Says NY Fed President

MarketWatch --Jan. 17, 2017

Not so fast! Usually when bank executives and politicians want consumers to spend more they suggest people should use their tax refunds, work bonuses or savings.

This time home equity is the source being suggested to boost the economy.

That suggestion is an incomplete half measure. Consumer spending is not a magic pill that fixes the economy, especially when the people doing the spending goes deeper in debt or uses all of their savings or equity..

The solution to a healthier economy lies in what puts more money into potential consumers hands to begin with:

Mainstream finance news should focus more on actions that put money into the bank accounts of people, not what takes it away.

--Ricky Moore

This time home equity is the source being suggested to boost the economy.

That suggestion is an incomplete half measure. Consumer spending is not a magic pill that fixes the economy, especially when the people doing the spending goes deeper in debt or uses all of their savings or equity..

The solution to a healthier economy lies in what puts more money into potential consumers hands to begin with:

- Stronger employment #'s based on businesses producing value that people seek.

- A financial environment that doesn't punish savers.

- Regulations that doesn't bury small businesses and also allows politically connected big businesses to have an advantage in the market. “Make no mistake. Tax, regulatory, government spending and other governmental performance and cost measures matter state by state. They have real impacts not only on entrepreneurship, investment, small businesses and their workers, but naturally therefore on the overall economy of each state,” said Raymond Keating, chief economist of the Small Business & Entrepreneurship Council.

Mainstream finance news should focus more on actions that put money into the bank accounts of people, not what takes it away.

--Ricky Moore

Higher Gas Prices Boost Inflation in October, CPI Shows

MarketWatch -- Nov. 17, 2016

The way the 'official' inflation report comes is via the CPI (Consumer Price Index). However some view the CPI as an outdated model or an intentionally misleading model.

--Ricky Moore

--Ricky Moore

Raising Premiums & Unsatisfied Customers -- NPR.com -- Oct 7, 2016

Excerpt:

In Georgia, consumers who don't get insurance through their employers or don't qualify for tax credits to help pay for policies they purchase are facing double-digit premium increases.

Blue Cross Blue Shield of Georgia, the only insurer offering plans throughout the state, received an increase of more than 21 percent from the state insurance commissioner. Humana was awarded a 67.5 percent hike.

Prices are going up in other states, too. BlueCross BlueShield of Tennessee was granted a 62 percent rate hike, while state officials approved a 46 percent increase for Cigna. Florida authorities gave plans there an average 19 percent bump. And last week, Minnesota officials announced that premiums for the seven insurers on the individual market are rising 50 to 67 percent.

Rest of Article

In Georgia, consumers who don't get insurance through their employers or don't qualify for tax credits to help pay for policies they purchase are facing double-digit premium increases.

Blue Cross Blue Shield of Georgia, the only insurer offering plans throughout the state, received an increase of more than 21 percent from the state insurance commissioner. Humana was awarded a 67.5 percent hike.

Prices are going up in other states, too. BlueCross BlueShield of Tennessee was granted a 62 percent rate hike, while state officials approved a 46 percent increase for Cigna. Florida authorities gave plans there an average 19 percent bump. And last week, Minnesota officials announced that premiums for the seven insurers on the individual market are rising 50 to 67 percent.

Rest of Article

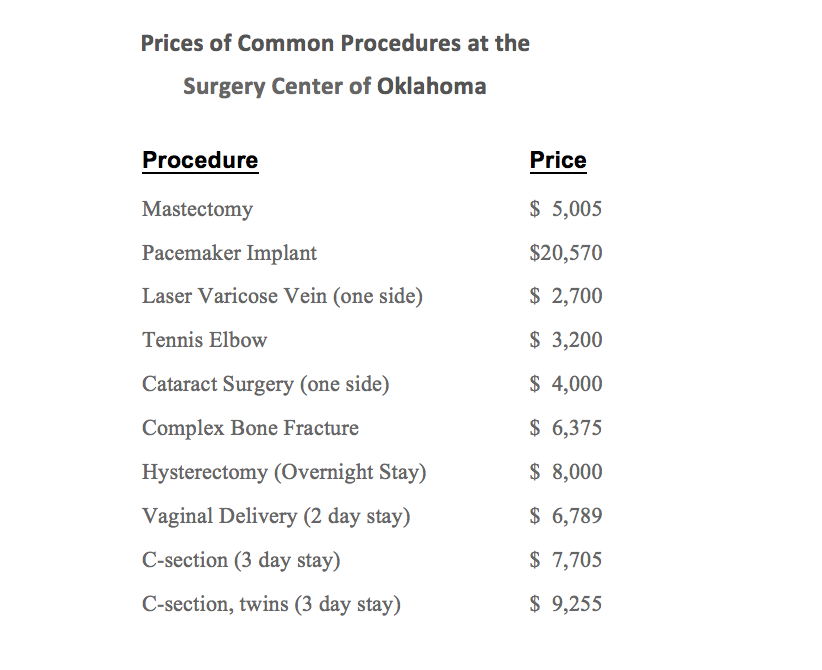

Note -- In a free market approach to healthcare:

- People wouldn't be fined (taxed) for deciding not to choose a service.

- Prices would be transparent to provide useful information for the patient to decide value and cost.

- Prices may actually be lower. (Most free market facilities choose to deal directly with the patient. Less bureaucracy, more efficiency, lower costs)

Gov't Seeks to Pay Affordable Care Act Insurers Billions of Dollars-- Washington Post Sept 29, 2016

|

Justice Department officials have privately told several health plans suing over the unpaid money that they are eager to negotiate a broad settlement, which could end up offering payments to about 175 health plans selling coverage on ACA marketplaces, according to insurance executives and lawyers familiar with the talks.

Full Article |

Banks are Fine with Fines as Long as They Can Continue Business as Usual -- Reuters.com -- Sept 16, 2016

U.S. Government seeks $14 billion from Deutsche Bank on claims that mortgage backed securities were sold fraudulently.

Excerpt:

The bank, which employs around 100,000 people, said it regarded the DoJ demand as an opening shot.

"Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited," it said in a statement.

"The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts." Rest of Article

I didn't read anywhere that Deutsche Bank contests these charges against them or that they admit guilt. Maybe they see paying these fines as the cost of doing business without any genuine desire to change how they operate.

--Ricky Moore

Excerpt:

The bank, which employs around 100,000 people, said it regarded the DoJ demand as an opening shot.

"Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited," it said in a statement.

"The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts." Rest of Article

I didn't read anywhere that Deutsche Bank contests these charges against them or that they admit guilt. Maybe they see paying these fines as the cost of doing business without any genuine desire to change how they operate.

--Ricky Moore

Medical Costs Jump in August by Largest Amount in 32 Years, CPI Shows -- MarketWatch.com -- Sept. 16, 2016

Medical care rose 1%, the fastest rate since 1984, the Labor Department said Friday.

The cost of prescription drugs also soared 1.3%, bringing the increase in prices over the past year to 6.3%. That’s the largest year-over-year increase in two years.

Higher drug prices have drawn criticism from lawmakers in Washington, especially Democrats, in the wake of a controversy involving Mylan, the maker of the EpiPen. The company jacked up the price so much that a public uproar ensued, forcing the company to scale back the increases. Rest of Article

CPI = Consumer Price Index

The cost of prescription drugs also soared 1.3%, bringing the increase in prices over the past year to 6.3%. That’s the largest year-over-year increase in two years.

Higher drug prices have drawn criticism from lawmakers in Washington, especially Democrats, in the wake of a controversy involving Mylan, the maker of the EpiPen. The company jacked up the price so much that a public uproar ensued, forcing the company to scale back the increases. Rest of Article

CPI = Consumer Price Index

Why So Negative? -- EuroPac.net -- Sept 9, 2016

|

For years I have argued that ultra-low interest rates act more as an economic sedative than a stimulant. This idea has elicited laughter from the economic establishment. But it is becoming clearer that rates set by central banks that are far below the levels that free markets would have otherwise determined have dragged the world into the economic mud. The simple proof is currently arising in Europe where negative interest rates are now transforming companies from agents of growth, production, and employment into financial sloths that exist solely to borrow money. Rest of Article

|

Even if you have health insurance, you may want to pay cash -- Los Angeles Times -- June 10, 2016

Five blood tests were performed in March at Torrance Memorial Medical Center. The hospital charged the patient’s insurer, Blue Shield of California, $408. The patient was responsible for paying $269.42.If that were all there was to this -- which it’s not -- you’d be justified in shaking your head and wondering how it could cost more than $80 apiece for blood tests.

These weren’t exotic procedures. The tests were for fairly common things such as levels of vitamins D and B12 in the blood.

It‘s what happened next, though, that this makes this story particularly interesting. The patient, who for privacy reasons requested that I use only her first name, Caroline, was curious about why she needed to pay almost $300 for a handful of routine tests. So she called the hospital. “I was completely surprised,” Caroline told me. “The woman I spoke with in billing said that if I’d paid cash, the prices would have been much lower.”

How much lower? Try this on for size: Tests that were billed to Blue Shield at a rate of about $80 each carried a cash price of closer to $15 apiece. Rest of Article

These weren’t exotic procedures. The tests were for fairly common things such as levels of vitamins D and B12 in the blood.

It‘s what happened next, though, that this makes this story particularly interesting. The patient, who for privacy reasons requested that I use only her first name, Caroline, was curious about why she needed to pay almost $300 for a handful of routine tests. So she called the hospital. “I was completely surprised,” Caroline told me. “The woman I spoke with in billing said that if I’d paid cash, the prices would have been much lower.”

How much lower? Try this on for size: Tests that were billed to Blue Shield at a rate of about $80 each carried a cash price of closer to $15 apiece. Rest of Article

Where Is All The Money Going?

Surgery Center of Oklahoma Video -- June 10, 2016

Politicians Argue Over Health Care, Small Businesses Are Fixing It -- TheEpochTimes.com -- May 13, 2016

Major health insurers have already begun to propose significant premium increases for next year in an attempt to cover their higher than expected costs from health plans on the Affordable Care Act’s exchanges.

In Oregon and Virginia, the first two states to propose rate hikes for 2017, insurers are asking regulators for premium increases of 30 percent and 20 percent, respectively.

This news comes on the heels of last month’s announcement by United Healthcare that it is essentially exiting the Affordable Care Act exchanges after losing more than $1 billion in 2015 and 2016.

Other major insurers like Health Care Service Corp. and Highmark also lost hundreds of millions of dollars in 2015. Rest of Article

In Oregon and Virginia, the first two states to propose rate hikes for 2017, insurers are asking regulators for premium increases of 30 percent and 20 percent, respectively.

This news comes on the heels of last month’s announcement by United Healthcare that it is essentially exiting the Affordable Care Act exchanges after losing more than $1 billion in 2015 and 2016.

Other major insurers like Health Care Service Corp. and Highmark also lost hundreds of millions of dollars in 2015. Rest of Article

Insurers Warn Losses From the Affordable Care Act are Unsustainable -- TheHill.com--April 15, 2016

|

Health insurance companies are amplifying their warnings about the financial sustainability of the ObamaCare marketplaces as they seek approval for premium increases next year.

Insurers say they are losing money on their ObamaCare plans at a rapid rate, and some have begun to talk about dropping out of the marketplaces altogether. “Something has to give,” said Larry Levitt, an expert on the health law at the Kaiser Family Foundation. “Either insurers will drop out or insurers will raise premiums.” Rest of Article |

Employer Health Benefits for U.S. Retirees Keep Declining

Reuters -- April 14, 2016

|

Excerpt: ...a growing number of U.S. employers are capping their risk of rising health insurance costs by sending retirees into private exchanges to buy coverage - often with little advance warning.

Rest of Article |

The Post-Crisis 'Fed Effect' for Stocks is Fading

Bloomberg.com -- Mar. 24, 2016

|

Excerpt from linked article:

'On a more rudimentary level, a number of analysts have also drawn attention to the strong correlation between the Federal Reserve's balance sheet and the S&P 500. But in a new white paper, strategists at Grantham, Mayo, Van Otterloo & Co., an asset allocation team known for its bearish bent, break down the extent to which the Fed may have juiced investor returns—not by easing policy, but merely by meeting.' Rest of Article |

For more regarding the 'Fed's Effect' on Wall Street read Case # 3 in my recent blog, Real Value Doesn't Come From Wall Street Games.

Is There Too Much Focus on Consumer Spending? -- HealthyAsses.org -- Mar. 4, 2016

Financial shows love to talk about consumer spending because that is what they consider to be the main signal of a strong and healthy economy. I believe this to be true enough but few questions that aren't brought up often enough is:

The answers to these questions helps determine just how strong our economy really is. Full Article

- Are consumers on a treadmill spending their income living paycheck to paycheck while trying not to go deeper and deeper in debt?

- Are people spending their savings on goods/services and investments that will help them recoup and even grow their money?

- Wouldn't the economy be healthier if people had enough savings and capital to invest and spend whenever they want without going broke?

The answers to these questions helps determine just how strong our economy really is. Full Article

Are Negative Interest Rates Coming to America? --

Chicago Tribune (Feb. 9, 2016)

|

Famous personal financial advisor Terry Savage goes a little into the consequences of what negative interest rates abroad would mean for saver. She is telling savers that are upset with the low interest rates in America to cheer up because it could be worse.

There are options currently available to preserve and grow your cash asset value even in today's low interest rate environment. (See here and here) |

Watching Out for Identity Thieves -- Arizona Republic (Jan. 21 2016)

Forbes Covers the Surgery Center of Oklahoma (Jan. 14. 2016)

Hospital Prices Vary Widely Across the United States

(Dec. 26, 2015)

|

Fortunately we have had a growing momentum of patients becoming more aware of actual healthcare prices.

When people become aware of the higher prices they pay for the same quality of care that can be provided cheaper, that's when places like the Surgery Center of Oklahoma, Atlas.MD, and Medibid are becoming more popular as they see their health practices grow. The theme these facilities or organizations has in common is that they offer price transparency. Their patients know exactly what they will get for hat they pay for. They are removing 3rd payor parties and unnecessary bureaucracy out of the way and fostering a more direct Dr/Patient relationship. |

Baby Boomers Must Be Careful & Take Advantage of Options in an Increasingly Stressed Healthcare System --

Hospital & Health Networks (Jan. 14, 2014)

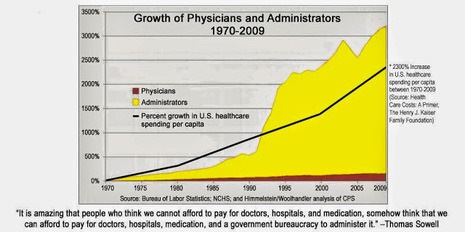

The findings "support an increased likelihood for continued rising health care costs and a need for increased numbers of health professionals as baby boomers age," -- JAMA Internal Medicine. ...Full Article

Are Outpatient Medical Care Prices Rising? --

The Wall Street Journal (Oct. 19, 2015)

|

The uptick in outpatient costs wasn’t due to physicians ordering or performing more services, the researchers found, because increases in utilization of outpatient care were “minimal.” Instead, it “was driven almost entirely by price increases,” ... Full Article

|

Is it Worth the Increase Costs to Stay in a Big Chain Hospital? --

Medical Economics (Aug. 6 2014)

|

...hospitals are purchasing physician practices at a fast clip and, according to the Medicare Payment Advisory Commission (MEDPAC), these practices are increasingly being converted into outpatient departments, which allows the hospital to be paid more for various services than does a freestanding physician’s office.

|

These fees are costing the healthcare system billions, and contributing to an unlevel playing field between independent practices and hospitals. Insurance coverage of facility fees varies, and many patients become stuck with large, sometimes crippling, medical bills as a result. Full Article

As Patients Sought Less Care, Medical Costs Rose --

Alter+Care (May 5, 2012)

Higher prices charged by hospitals, outpatient centers and other providers drove up healthcare spending at twice the rate of inflation during the financial crisis – even as patients sought less medical care, according to the first-ever Health Care Cost and Utilization Report.

Full Article

Full Article