For years it seems that news headlines have covered how low interest rates have

hurt your chances to preserve and grow your savings.

|

|

In an attempt to spark the economy, the Federal Reserve believes low rates will encourage people and businesses to take out loans and make the economy stronger by starting businesses and spending more.

However for CD owners, as well as owners of savings and other traditional accounts, low interest rates has made it difficult for people to hold on to and grow their savings. Unfortunately for savers, low interest rates have stayed with us for years as the slideshow illustrates. |

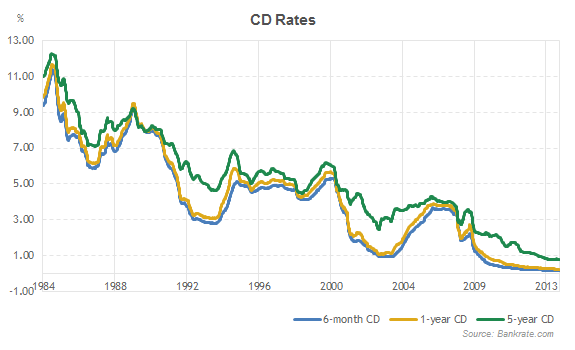

Rates have remained near 0% for over 7 years, leaving savers to deal with very little growth in their bank and CD accounts as the CD chart below shows:

CD Disadvantages

Low Interest Rates

|

CD’s used to be very respectable back in the 1980’s reaching rates of 11% to 13%. These days you are lucky if you can find a CD rate over 2%.

Low rates don’t just hurt people on a fixed income, they can interfere with anyone’s long term plans to grow their cash value. In the past, most people put a portion of their income into a CD with the assumption that a CD was a safe place to set money aside as they continue to work throughout the years and their CD earned consistent, steady growth.

|

Currently the majority of CD's cannot get enough traction to accumulate value that is worthwhile for their owners.

Tax Rate and Inflation Rate

|

Besides low interest rates there are 2 other issues in the way that prevents CD's from earning substantial value.

For the sake of easy math, let's say that at the start of the year 2015 you had $1000 in a CD earning 1.5% interest and your income tax rate is 28%. 1 year at maturity the CD would be worth $1,015. $15 of annual growth is small amount to begin with but now we have to calculate the income tax rate of the CD owner. Only the growth portion of the CD is taxed at our 28% example which brings the CD value to $1010.80. |

The 'official' inflation rate for 2015, was 0.5%, in other words at the end of 2015, your money purchased 0.5% less than it did at the start of 2015.

In our current example that brings our original $1000 CD to a final yearly growth of about $1,006. 0.5% inflation rate may not seem like much but it matters when your CD rate is hovering around only 1.5% or lower. In this example the growth rate is about 50 cents a month.

$1,000 earning only 50 cents a month is exactly why people are looking for different options that offers them substantial value.

In our current example that brings our original $1000 CD to a final yearly growth of about $1,006. 0.5% inflation rate may not seem like much but it matters when your CD rate is hovering around only 1.5% or lower. In this example the growth rate is about 50 cents a month.

$1,000 earning only 50 cents a month is exactly why people are looking for different options that offers them substantial value.

An Asset Care Life Policy Can Help You More than a Low Interest Rate CD Can

Compared to a CD, an Asset Care life policy will:

- Offer you tax deferred growth at a faster rate than most, if not all CD's.

- Increase your asset value significantly, allowing you to use your increased value on potential long term care medical (LTC) expenses income tax free.

- Offers inflation protection and lifetime LTC coverage if needed.

- Keep the increased asset value with you and your beneficiaries if you never need LTC.

Comparisons

This is a one time single premium Asset Care example, for lower annual premium, call me for quotes:

240-644-4376

--Ricky Moore

240-644-4376

--Ricky Moore

Mary, a 60 Year Old Non-Smoking Female has $25,000 that she wants to put somewhere to preserve her cash value. Below are comparisons of what she could get with a 5 Year CD and a Single Premium Life policy:

5 Year CD (2.25 Interest Rate)$27,977

(minus the income tax rate) In 5 years Mary would have roughly only $2,977 in growth before taxes reduce this amount even more. |

OneAmerica's Asset Care Single Premium$50,732

Policy Benefit Mary's initial premium immediately gives her an extra $25,732 in asset growth that she can use to help her with life emergencies such as potential long term care costs. Mary can also leave her increased asset growth behind to your family/charity/beneficiary income tax free. |

OneAmerica's

Asset Care

Review the information that I have on the pages of HealthyAssets.org,

Then fill out the form below or call me for a free quote and have your questions answered.

Call for your free quote

Ricky Moore

240-644-4376 (Toll Free #)

info@healthyassets.org

Ricky Moore

240-644-4376 (Toll Free #)

info@healthyassets.org