Why Should I Know About Gold & Silver?

|

When the stock market goes down, many investors run towards gold as a safe haven to secure the value of their money.

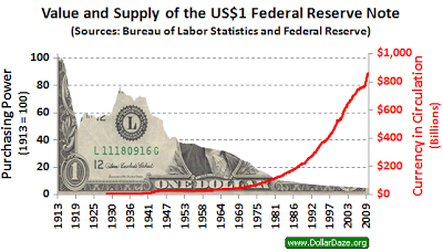

The American dollar used to be backed by gold until President Nixon severed their connection back on August 15, 1971. Because the dollar has not been backed by anything of substance since, the separation of the gold/dollar link has contributed to America's rising debt levels and dollar instability. When the dollar was backed by gold, it served as a measure of reality when it came to government budgetary issues. |

|

Gold and silver's value has been known to be consistent and stable.

People have depended on its value because they can be used for multiple purposes and provide a variety of benefits. Their intrinsic value was obviously sought after.

Gold & silver was traded for goods and services throughout American history and abroad.

People have depended on its value because they can be used for multiple purposes and provide a variety of benefits. Their intrinsic value was obviously sought after.

Gold & silver was traded for goods and services throughout American history and abroad.

|

With paper currency no longer backed by gold the door was now wide open for increased spending and higher debt levels courtesy of the partnership between the Federal Reserve and our American government.

Spending by politicians, higher debt levels and central bank debt schemes increases the paper money supply but not the paper money's value. |

These days, the value of the American dollar currently depends less on hard work and productivity and more on the Federal Reserve's paper money debt games:

The reasons above are a few reasons why more and more people are looking to gold as the safe haven to strengthen the value of their paper money.

Signs of a Weak Economy Causes Gold's Value to Rise

|

|

- In America, Texas seeks to get it's gold back that is currently stored inside the Federal Reserve.

People, states and countries are now moving away from the dollar to conduct their own business

Chinese leader Xi Jinping & President Putin have sought ways to lower their respective countries dependence on the American dollar.

Chinese leader Xi Jinping & President Putin have sought ways to lower their respective countries dependence on the American dollar.

From an Examiner.com article in 2013:

The list of the 23 countries which are creating new swap lines outside of the dollar include China, Russia, India, and surprisingly, Germany, France, and the United Kingdom. This means that the Eurozone itself is abandoning the dollar, and preparing for transition to a new central banking system.

To facilitate the transfer of currencies and swap lines, there needs to be a bank of sufficient size and stature to aid in handling of this monumental task. One year ago, China, along with the BRICs nations of Brazil, Russia, India and South Africa, loaned money to a new financial institution they established and labeled the BRICs bank. This bank was created with the intention of bypassing the dollar, and allowing free trade to occur between nations without the need to trade for dollars first, as is currently the format under the petrodollar system.

The list of the 23 countries which are creating new swap lines outside of the dollar include China, Russia, India, and surprisingly, Germany, France, and the United Kingdom. This means that the Eurozone itself is abandoning the dollar, and preparing for transition to a new central banking system.

To facilitate the transfer of currencies and swap lines, there needs to be a bank of sufficient size and stature to aid in handling of this monumental task. One year ago, China, along with the BRICs nations of Brazil, Russia, India and South Africa, loaned money to a new financial institution they established and labeled the BRICs bank. This bank was created with the intention of bypassing the dollar, and allowing free trade to occur between nations without the need to trade for dollars first, as is currently the format under the petrodollar system.

When the dollar was backed by gold, America's economic strength made the dollar the currency of the world. America's economy was trusted, American companies made goods that were sold abroad.

America was a surplus nation when the dollar was backed by gold as opposed to a debtor nation that it is today.

As the above excerpt alludes to, countries no longer see the same level of safety in the dollar as they did decades ago.

Now countries and at least one American state wants their gold back in their possession to protect their finances from the fluctuating loose roller coaster ride of the dollar.

America was a surplus nation when the dollar was backed by gold as opposed to a debtor nation that it is today.

As the above excerpt alludes to, countries no longer see the same level of safety in the dollar as they did decades ago.

Now countries and at least one American state wants their gold back in their possession to protect their finances from the fluctuating loose roller coaster ride of the dollar.

It has gotten easier over time to lower the value of paper currency:

Low Interest Rates -- With constantly low interest rates there is little incentive to work and save your money because the interest received is not worth people's time and energy. Low interest rates is a sign of low confidence in the economy because banks are not willing to give depositors higher interest value over time.

Fractional Reserve Banking -- This is when banks intentionally loan out more money than they have secured with depositors money. This practice increases the money supply but can also dilute the value of the dollar. This practice can also cause chaos if all of a banks customers requested their money at the same time.

Quantitative Easing

Fractional Reserve Banking -- This is when banks intentionally loan out more money than they have secured with depositors money. This practice increases the money supply but can also dilute the value of the dollar. This practice can also cause chaos if all of a banks customers requested their money at the same time.

Quantitative Easing

|

|

Quantitative easing increases the money supply without the necessary logical, substantial reasons to do so.

In other words a debt was issued to create new money and urge more spending. Eventually all of this newly created money can cause false booms in certain markets leading to a false demand and higher prices. What is missing in this equation is the natural wants and needs based on people's ability to pay without the help of money created based on debt instruments. |

|

Gold and silver is not a magic pill that will make you rich instantly. Instead it is an option to preserve the buying power of the dollars that you currently have.

There is no guarantee that their value will always go up and up. Their value fluctuates and can go down as well. Some of the reasons why will be covered in future articles. |

|

|

What is definitely known is that gold and silver have a unique place in the history of finance.

Because its value can physically be seen for their multiple uses and benefits and be traded for goods and services, people have trusted these metals throughout history with their economic transactions. The value of these metals becomes more apparent to some people as the trouble with paper currency becomes obvious. |

|

Besides the dollar, currencies all over the world have lost it's value as the central banks of other countries try to manage paper currency not backed by gold. Japan's central bank struggles with credibility while negative interest rates have been used by other central banks.

Information Sources for Gold & Silver:

In my view, it is definitely worth a look to research the world of gold & silver investing to see if this kind of asset protection is for you.