|

On November 30, 2016, ZeroHedge.com posted information on their site about how the Dallas Police and Firefighters Pension (DPFP) Board:

'discovered that one of their real estate managers had been consistently overmarking illiquid real estate investments. That discovery resulted in an FBI investigation of the manager and a $1BN write down for the DPFP. In the wake of the writedowns, Dallas policemen and firefighters rushed for the exits and withdrew over $500mm in assets. Fearing a "run on the bank" that could push the whole city of Dallas into bankruptcy, Mayor Mike Rawlings has just sent a scathing letter to the DPFP Pension Board demanded that withdrawals be halted immediately until the "solvency and actuarial soundness of the Pension System is restored."' While this story just seems to be about alleged abuse and mismanagement of funds, there are questions that should be asked whenever a financial committment might be made

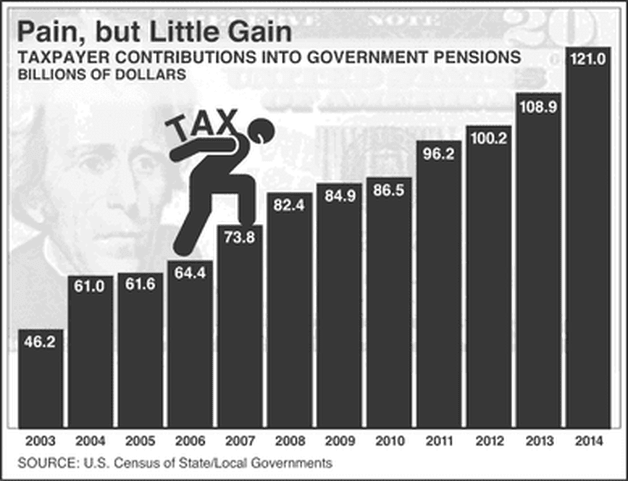

These police officers and firefighters were promised an 8% return. In today's economy, that figure for a typical pension should be a red flag for the cautious and aware:

More Pension Issue Stories to Come...

I believe that in the next few years there will be more stories of pensions not living up to contractual promises. Our current economy is propped up more by financial tricks and games than it is by tried and true economic principles of savings, smart loan choices and real business development that hires more people and brings quality of life choices to consumers through market competition. If investment choices aren't based on real world growth and production then what exactly are they based on? It seems fraud and deceit brought down the pensions of the Dallas firefighters and police officers discussed in the ZeroHedge article linked above.

Bottom line: watch your pensions as if your retirement life depends on it because it likely will for most peeple. UPDATE:It should serve as a wake up call that legistration is being drafted that would require Dallas policeman and firefighters to payback some of their pension benefits. Just as former pension board trustee, Lee Kleinman says in the video above: ''Well I think it was unfair that they (pensioners) were made those promises in the first place. That was what was wrong.'

Benefit plans should be based on real value that you can see and say 'Here is proof why my investment / pension / stock, etc. is making money.

Taking the word of a financial manager is not enough to feel good about an investment. As always, proactive due diligence can save your finances from harm.

Ricky Moore

Independent Asset Management Agent

2 Comments

Ricky Moore

5/19/2022 05:24:14 pm

Thank you, Stacy!

Reply

Leave a Reply. |

BlogsObserving the Cause/Effect cycle of economic systems. Archives

November 2020

Categories |

RSS Feed

RSS Feed