Definition of Insurance:Compensation provided to offset the loss caused by a potential event or outcome. Examples:

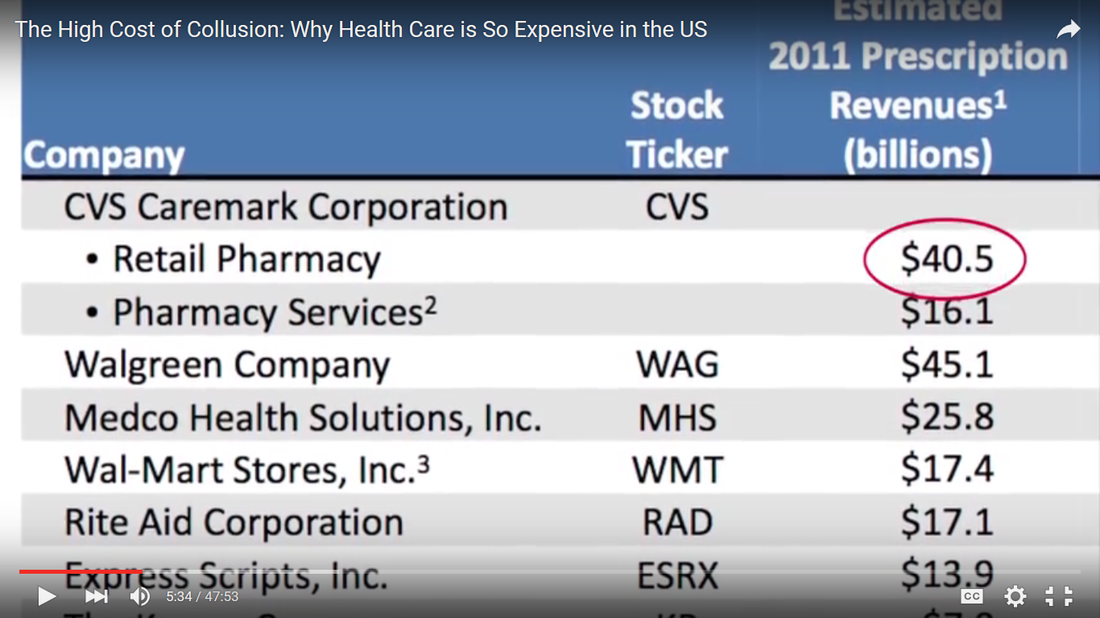

One reason why health insurance is so expensive is because in addition to providing compensation to handle serious medical events in your life (which is what they should do), health insurance companies also involve themselves with things that you can probably handle on your own. In fact, without your insurance company’s involvement your costs might be less expensive. Prescription Drugs From CVS: ‘During 2011, 2010 and 2009, our pharmacy gross profit rate continued to benefit from an increase in generic drug revenues, which normally yield a higher gross profit rate than equivalent brand name drug revenues.‘ What CVS is telling us is that there is a lot of profit to be made with their growing generic drug revenues. Is it because generic drugs are usually more expensive than brand name drugs? No. The reason is because most of these generic drugs are paid for using a combination of a customer’s co-pay and the health insurance company’s negotiated rate. Pharmacies like CVS will not complain about this arrangement because their expected growth rate of generic drug prescriptions in 2011 was $40.5 billion dollars. When plenty of generic drug pills costing only .30 cents or less there is a huge markup even when the customer only has a monthly copay of just $5 or $10. There are many cases where you can save money by paying a lower cost directly to your pharmacy and avoid the higher costs arranged by your health insurance’s negotiated payment arrangement. In the video below Dr. David Belk covers examples of inflated prescription drug prices caused by insurance companies' intervention. For information on how you can possibly save your money on prescription drugs, visit http://truecostofhealthcare.net/ ConclusionBased on the information provided in Dr. Belk's video above, customers would be better off learning the true cost of prescriptions without their insurance company's involvement and if they can pay a lower price for the same prescription then all the better for the customer, especially the elderly that are on a fixed income.

When insurance companies interfere and cause the price of prescriptions to rise they are no longer providing true insurance protection. Raising the expenses that a customer has to pay is not insurance at all. While politicians argue back and forth on our health care system. They should all remember or learn what the true definition of insurance actually is.

A good question is asked by Alan Amdahl, an economics teacher of an Albany, Minnesota high school regarding the historic low interest rates of savings accounts across the country. The question he asks is:

'How can we teach students that they will be rewarded for saving given that returns on investments are currently so low?' The answer that is given by the former Federal Reserve Chairman, Ben Bernanke, is a little incomplete in my opinion. Mr. Bernanke attempts to make the point that interest rates have been low but '...they're low for a good reason... which is that our economy is still in a fragile recovery and low interest rates are intended to help the economy recover...' he goes on to say, '...ultimately, the best way to improve the returns attainable by savers was to do what the Fed actually did: keep rates low...'

So around the year 2008, the decision makers at the Fed decided to lower interest rates to near zero which indirectly meant lower savings rates for bank customers across the country. This was done for the purpose of... in Bernanke's own words '...so that the economy could recover and more quickly reach the point of producing healthier investment returns.'

The logic behind this course of action is to inspire economic activity in the form of borrowing loans for (1) business and (2) spending needs (1) Business -- With rates so low, it is easy for entrepreneurs and business owners to borrow money to start businesses and potentially create positive cashflow to expand businesses and create stable incomes for employees which can lead to higher consumer spending. (2) Spending Needs -- As was covered in my last blog, the mainstream financial media believes consumer spending is needed to nurture a strong economy. By people taking out loans to purchase homes, cars etc. it is expected that this spent money will get mixed into economy and hopefully spur growth. Has the economy recovered to the point where people can expect higher interest rates on their savings and investment accounts?

Depends on who you ask?

Bloomberg host, Tom Keene, asks how has 'interest rate illusion' determined business investments, sales and profits?

This video covers how the Federal Reserve may have to consider something else other than low interest rates to spur the economy. They bring up the suggestion of negative interest rates which basically means that instead of people earning interest a bank would begin charging you for depositing your money with them.

Even though negative rates is in the very early discussion stage right now it should be obvious that had low interest rates did their expected job of growing the economy then negative interest rates wouldn't be thought of in the first place. (A future blog will go into why negative interest rates are being considered at all.) Why Can't Individual Banks Offer Higher Interest Rates on Their Own?

Technically they can however this would be going against the grain of the very system that a bank is supported by. Thanks to fractional reserve lending banks aren't really in a position to offer higher interest rates to their depositors. They would first have to keep more cash in their reserves to comfortably satisfy higher rated accounts. Otherwise they would need access to the Federal Reserve's cash to meet the contracted demands of savers.

Since it is a typical practice of our central bank to purchase bonds (debt instruments) to create the cash available for banks to provide to their customers, the rates have to be manageable (lower) than a stronger healthier economy would be able to handle, in my view.

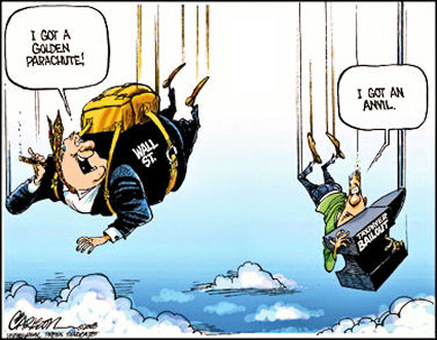

It may just be the first step to responsible banking if banks managed their lending and savings rates based on their ability to effectively attract money through discernment and stable investment choices as opposed to low cash reserve requirements and having the Federal Reserve available to bail them out with extra cash.

Considering the track record of the last 8 years, higher savings rates worth mentioning seem to be a long ways away. To answer Alan Amdahl's question posted at the start of this article:

'How can we teach students that they will be rewarded for saving given that returns on investments are currently so low?'

Financial shows love to talk about consumer spending because that is what they consider to be the main signal of a strong and healthy economy. I believe this to be true to a certain point but there are some questions that aren't brought up often enough by the typical financial pundits you see on tv:

The answers to these questions help determine just how strong our economy really is.

Just focusing on how retail stores are doing during the holiday season doesn't tell the whole story. If consumer spending helped big retail stores make a lot of profit in one year but during that same time the average consumer went deeper into debt without any savings to fall back on, is that the sign of a good economy?

Don't get me wrong, I understand that there are millions of people employed in the United States by small to large retail companies and that more consumer sales translates to better job stability for retail employees. Still, there is a unique balance between savings and spending that doesn't get enough attention on financial shows in my opinion. The private concerns of a potential consumer may just mean more to their own well-being than the latest profit report of Wal-Mart or Target.

Between rent and mortgage payments, the needs of their children or their parents, wondering if their salary will be enough to handle their weekly expenses. These things are more important to most people than whether or not the stock prices of retail companies are high.

Consumer spending while important, doesn't give a complete picture of the economy.

A person's ability to save, preserve their purchasing power and get healthy returns on their money gives a better all around view of the economy. This is because the consumer spending that does take place will ideally come from a stronger, more stable foundation. Consumers would be less dependent on loans or credit when they make purchases so they wouldn't feel as overwhelmed under growing debt as many consumers today do. They also wouldn't have to wait until next Friday (payday) to get what they want or need. Without needing to pay off as much past debt means more income and capital can be used however a person sees fit to maintain or improve their lifestyle. Retail and other businesses need our money to continue to exist and grow, that is understandable, no hard feelings there. We just shouldn't go too deep down the debt hole to keep their annual sales reports positive. Consumer Debt -- Huffington Post - April 20, 2014

Less Consumer Debt Defaults -- CNBC -- June 16, 2015

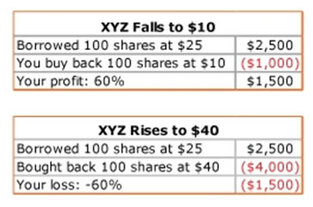

Case # 1: The Wrong Bet -- MarketWatch.com |

|

It is obvious to everyone that healthcare expenses are very high and the quality of healthcare provided doesn't seem to improve along with the rising costs.

Most people blame doctors' incomes for the expensive costs of healthcare. This Forbes article shows that doctors shouldn't be the main scapegoat for high medical costs. |

Here's an excerpt:

'...physicians are not necessarily the principal beneficiaries of healthcare spending. The bulk of medical procedure payments go to hospitals and device manufactures. For example, in California, Medicare pays on average $18,000 for a total hip replacement – $16,336 to the hospital and $1,446 to the surgeon. This reimbursement disparity is certainly not limited to California, and is representative of a broader trend on a national level.'

Based on available figures the majority of the costs patients pay goes to administrative costs.

In this case above, the doctor's compensation is roughly just 8% of the $18,000 cost of the total hip replacement.

Approximately 92% of the $18,000 went to the hospital and the device manufacturer(s).

A 2008 New York Times article had this to say about the extra spending:

'One thing Americans do buy with this extra spending is an administrative overhead load that is huge by international standards. The McKinsey Global Institute estimated that excess spending on “health administration and insurance” accounted for as much as 21 percent of the estimated total excess spending ($477 billion in 2003). Brought forward, that 21 percent of excess spending on administration would amount to about $120 billion in 2006 and about $150 billion in 2008.'

Money spent on hospital administrative and 3rd party costs drives up the price for healthcare far more than a doctor's compensation. This can be an issue for patients as care and service can be delayed while paperwork/fees goes through different departments of the hospital's administrative process.

Can at least some of the bloated administrative costs be reduced?

What would happen if a doctor was able to deal directly with the patient without bureaucracy and 3rd parties getting in the way and driving up costs?

Perhaps the best example of what can be done is happening at the Surgery Center of Oklahoma.

'...physicians are not necessarily the principal beneficiaries of healthcare spending. The bulk of medical procedure payments go to hospitals and device manufactures. For example, in California, Medicare pays on average $18,000 for a total hip replacement – $16,336 to the hospital and $1,446 to the surgeon. This reimbursement disparity is certainly not limited to California, and is representative of a broader trend on a national level.'

Based on available figures the majority of the costs patients pay goes to administrative costs.

In this case above, the doctor's compensation is roughly just 8% of the $18,000 cost of the total hip replacement.

Approximately 92% of the $18,000 went to the hospital and the device manufacturer(s).

A 2008 New York Times article had this to say about the extra spending:

'One thing Americans do buy with this extra spending is an administrative overhead load that is huge by international standards. The McKinsey Global Institute estimated that excess spending on “health administration and insurance” accounted for as much as 21 percent of the estimated total excess spending ($477 billion in 2003). Brought forward, that 21 percent of excess spending on administration would amount to about $120 billion in 2006 and about $150 billion in 2008.'

Money spent on hospital administrative and 3rd party costs drives up the price for healthcare far more than a doctor's compensation. This can be an issue for patients as care and service can be delayed while paperwork/fees goes through different departments of the hospital's administrative process.

Can at least some of the bloated administrative costs be reduced?

What would happen if a doctor was able to deal directly with the patient without bureaucracy and 3rd parties getting in the way and driving up costs?

Perhaps the best example of what can be done is happening at the Surgery Center of Oklahoma.

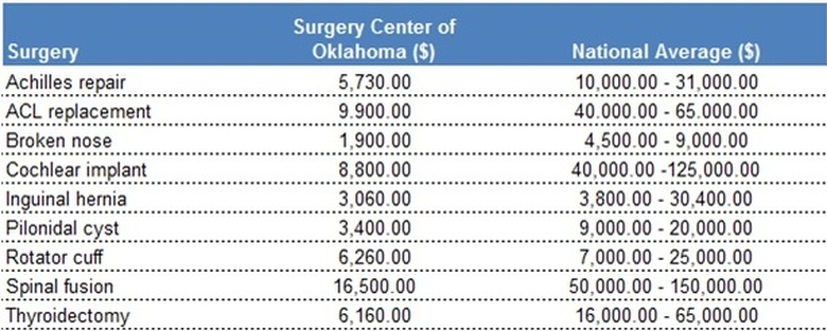

Surgery Center of Oklahoma Price Comparison

The founding doctors, Dr. Keith Smith and Dr. Steven Lantier, own their facility. They do not work for a bureaucratic hospital. They tell patients their prices upfront so you can compare them to hospital surgeons fees.

When asked how the Surgery Center of Oklahoma can offer these lower prices to patients, Dr. Keith Smith has mentioned in several interviews that he doesn't have to waste his and the patient's time dealing with hospital administration actions and insurance companies that raises costs and interferes with the care provided to his patients.

People come to the Surgery Center of Oklahoma from all over the world for medical services, patients even come from Canada (the country that's supposed to have a good reputation for healthcare).

By working with the patient directly and not having to deal with expensive hospital overhead costs, this surgery center can just offer the costs of the service which translates to steep price discounts for the patient.

According to Dr. Keith Smith, who helped start the Surgery Center of Oklahoma back in 1997, he gets letters every week from patients who are happy to tell him that they had their local hospital lower their original price and match the Surgery Center's price for medical service. Hospitals are forced to either reflect a more honest pricing system or lose their patients to facilities like the Surgery Center of Oklahoma.

While politicians argue and blame each other for rising healthcare prices. The Surgery Center of Oklahoma is successfully providing much needed high quality medical care while also eliminating the bureaucracy of 3rd parties. They have shown how healthcare costs can be reduced by having a system of transparent pricing. Allowing patients to see where their money is going when they pay for medical services. Price transparency is a rare occurrence in our current healthcare model system. Many times even doctors aren't aware of medical costs, they just tell their patients that it will be ok because their insurance covers the prescription or operation.

With price transparency and direct patient/doctor communication, patients have a better understanding of how much of their hard earned money is actually going towards their medical care as opposed to wasting away deep into the hospital administrative process.

The Surgical Center of Oklahoma shows people that there is a better option other than waiting for politicians and bureaucrats to solve the problem.

HealthyAssets.org will provide information on how people are finding ways to reduce their healthcare costs while also receiving high quality care.

Videos related to this article

Dr. Keith Smith Explains How & Why the Surgery Center of Oklahoma can offer High Quality Low Cost Care

Billing Terms Can Increase Your Hospital Costs

A theme mentioned in this article is for patients to have a direct relationship with their doctor so they can have more control of decisions regarding their care. I should still mention that I do believe that patients should do as much research as possible when it comes to the opinions and statements made by their doctor.

Whatever situation you may go through, search online to see how other people have received care for the same issue and how successful they were at restoring their health. See what options are available and which option you feel most comfortable with and then explain your thoughts to your doctor.

This way there is a true meeting of the minds as opposed to just accepting what your doctor has to say. This is the reason for getting a second opinion but now with information all over the internet you can research even more opinions and search for the evidence that backs up the claims of other people. Your health is too important for just one person to decide what must be done for you. To your health -- Ricky Moore.

Whatever situation you may go through, search online to see how other people have received care for the same issue and how successful they were at restoring their health. See what options are available and which option you feel most comfortable with and then explain your thoughts to your doctor.

This way there is a true meeting of the minds as opposed to just accepting what your doctor has to say. This is the reason for getting a second opinion but now with information all over the internet you can research even more opinions and search for the evidence that backs up the claims of other people. Your health is too important for just one person to decide what must be done for you. To your health -- Ricky Moore.

Blogs

Observing the Cause/Effect cycle of economic systems.

Archives

November 2020

January 2017

December 2016

October 2016

July 2016

May 2016

April 2016

March 2016

February 2016

January 2016

RSS Feed

RSS Feed