|

Yesterday in the 'News' section of HealthyAssets.org, I linked to an NPR article covering how people aren't happy with their health insurance premiums that are set to rise yet again in 2017. Some of the examples NPR listed were: Humana in Georgia = 67.5 % premium hike. BlueCross BlueShield of Tennessee = 62 % premium hike. Seven insurers on the individual market in Minnesota are raising premiums = 50 to 67 percent Affordable Care Act premiums in Florida = 19 % premium hike. This has become an annual tradition with most of the big name health insurance companies as they have increased their rates in the past before. The same NPR article explained one reason for the higher premiums: 'While consumers have faced sticker shock, the insurers have faced what might be called "sicker shock." They are raising premiums after finding that many of the customers buying plans on the individual market were sicker and more costly to insure than expected when the health law was implemented.' True. If more people with current healthcare needs are enrolled then more money will be spent by insurance companies than they expected and premiums would be raised to cover their costs... and cover the profit margins they are used to.  Another reason to consider is that the entire healthcare insurance model is seriously flawed. For starters, health insurance companies that increase their premiums are too much involved in the decision making process regarding the care their customers can receive. In addition, a lot of the service options provided by insurance companies doesn't fit the true definition of insurance. When it comes to the big name health insurance companies there is a profit motive for them that goes far beyond the best interests of their customers. What should be a direct doctor/patient relationship is often hijacked by an insurance company whose involvement can increase prescriptions prices and dramatically raise the cost of surgeries. The $100 AsprinYou may have heard the stories about ridiculously high prices many big chain hospitals have charged for an aspirin pill. Dr. Keith Smith of the Surgery Center of Oklahoma explains the details covering the relationship hospitals have with insurance companies when it comes to prices.

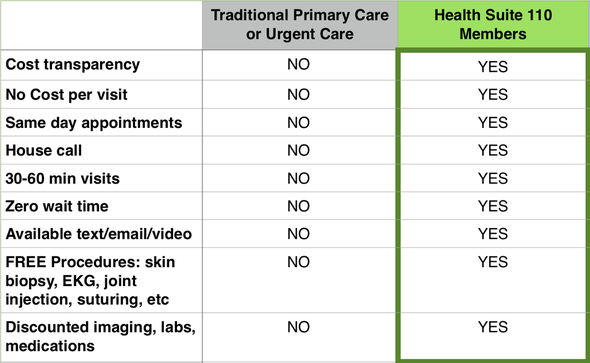

Collusion to raise prices isn't insurance.Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients' risks to make payments more affordable for the insured. --investopedia.com This specifically applies to circumstances that a person couldn't financially handle on their own. There is car insurance for car accidents, there is home insurance for fire or theft. These are examples where insurance is meant to cover costs so you can maintain or get back to the same quality of life you enjoyed before you had an accident or experienced an unfortunate incident. In the case of healthcare, insurance is meant to pay for catastrophic issues that can be addressed without bankrupting your family. Catastrophic issues such as a physical illness or an accident that can cause you to miss work for months or years qualifies as something that insurance should cover. Paying $100 for aspirins that cost pennies to make shouldn't qualify as an insurance service, but it does and that is part of our current healthcare problem. A More Efficient Healthcare ModelIt is a fact that your choices are limited by the service options your insurance company will approve. If you were to remove the 3rd party insurance company out of the way then now the door is open to a more direct relationship with your doctor where all options to your care can be discussed and you can decide which route you want to take. The cost of your care can go down dramatically as well now that your insurance company isn't involved with every single decision. Patients of Health Suite 110 pay what they see as an affordable monthly fee which gives them tremendous access to their physician while receiving discounts on a variety of services. Discounted imaging, labs and medications can help these patients lower their monthly premiums by having their insurance company cover only bigger, more pertinent, catastrophic events. Atlas.MD helps their patients reduce their insurance premiums by 60 % Dr. Josh Umbehr of Atlas.MD explaining the advantages of a Direct Primary Care model Dr. Josh Umbehr of Atlas.MD explaining the advantages of a Direct Primary Care model Dr. Josh Umbehr of Atlas.MD was my first introduction to the Direct Primary Care model. Atlas.MD has saved families and employers up to 60% on their insurance costs because they provide their patients with services that no longer need to be covered by their insurance companies. Again, for a monthly fee, patients have much more control of the care they receive and they can now readjust their health insurance policies to reflect the reduction of services their insurance would now provide. The Surgery Center of Oklahoma helped save Oklahoma County $1.7 MillionAs I mentioned in my article about Dr. Keith Smith and the Surgery Center of Oklahoma, by not dealing with insurance companies whose involvement insanely drives up the price of surgeries, Dr. Smith's facility is able to offer dramatically reduced prices for his medical care. How does he do this? He only charges for his time and the cost to do the surgery. Simple and direct. No insurance company needed to negotiate a higher charge, no inflated overhead costs to pay staff workers to shuffle papers along and not have any direct impact delivering care to the patient. At Dr. Smith's facility it is now common to see savings anywhere from $5,000 to over $20,000 per surgery compared to what big chain hospitals charge for the same procedure. This surgery center has also saved Oklahoma County 'at least $1.7 million in insurance outlays and an estimated $250,000 in patient copays.' -- JournalRecord.com All of this is possible by eliminating the need of third parties and bureaucracies, both of which are completely synonymous with insurance companies. These are real world examples of healthcare services being provided to patients at lower costs, quite the contrast to the neverending stories of insurance companies seeking and receiving premium increases that their increasingly frustrated customer base pays. Insurance is a simple contract. 'I pay premiums, if such and such happens, my insurance company will give me _______.' It is when insurance companies act outside the scope of their definitive responsibilities that the door is now open to rising costs for patients. Using insurance to cover an office visit or paying for highly inflated prescription costs is not true insurance. As long as we have this kind of system healthcare will continue to be expensive. What is needed is true freedom of choice for a patient to discuss care options with a doctor he/she is comfortable with. Regarding choices, there needs to be market competition where a person can determine who provides the best value to deliver their healthcare needs. This means insurance companies would not get any favors from the government restricting market competition and ultimately driving up costs. Price Transparency: A Growing Trend in Healthcare?The cost of care is clearly known and the patient determines if they want to pay for such care. There are organizations out there that promotes the idea of having a simple doctor / patient relationship. The Free Market Medical Association in particular is one that I am very familiar with. This association was formed by Dr. Keith Smith of the Surgery Center of Oklahoma and J. Kempton Jr. of The Kempton Group, a facilitator for providing savings to employers and their employees through self-funded plans. Just as Dr. Smith and the independent doctors at the Surgery Center of Oklahoma have saved Oklahoma County millions of dollars, The Kemption Group has helped employers throughout the years save millions on the healthcare needs of their employees. The passion of these two men to provide value, high quality care and savings to their patients and clients is what drove the Free Market Medical Association to be created. This organization is comprised of medical professionals and professionals in other fields, all who believe in a more efficient model of healthcare. You may not be able to tell based on the articles I write about insurance companies but I am a life insurance agent. However, I believe my clients need to be aware of the options they have to preserve their assets. What better way to preserve their assets by showing them that they do not have to spend grossly inflated costs on healthcare that reduces or potentially eliminates their savings? If you are interested in getting a better understanding of how you can take control of your healthcare and only use insurance companies for the potential emergencies in life then please visit FMMA.org, if you are on Facebook, look up and 'Like' the following: The Surgery Center of Oklahoma Atlas.MD Health Suite 110 The Wedge of Health Freedom Zarephath Health Center Free Market Medical Association To your health,

Ricky Moore

0 Comments

Leave a Reply. |

BlogsObserving the Cause/Effect cycle of economic systems. Archives

November 2020

Categories |

RSS Feed

RSS Feed