|

Diabetes is a chronic disease that need not be one in my belief. Without overwhelming you with too much diabetic lingo, most diabetics have in their control what they are going to eat and what activities they will do after they eat. Scenario 1: A diabetic eats a carbohydrate heavy dinner* then sits down on the couch for 2 hours to watch television. Typical result: Growing evidence as well as the common experience most diabetics have tells us that blood sugar will drive up higher when you eat foods that convert to sugar in our bodies. Carbohydrates tend to have foods with higher glycemic index rates than foods with more healthy fats and moderate protein. So when a diabetic has their carb heavy dinner then sits down for awhile, their blood sugar is more likely to go up to the point where medication is needed to drive the blood sugar back down to a normal range. For diabetics, this cycle continues until more and more medication is needed to drive blood sugar back to a normal range, sadly after a few decades of this daily living pattern, complications such as blindness, strokes or amputations can follow. Scenario 2: A diabetic eats a carbohydrate heavy dinner* but then decides to go for a short walk soon after eating. Evidence shows that walking after a meal can contribute to healthier blood sugar levels. '“Most of this effect came from the highly significant 22 per cent reduction in blood sugar when walking after evening meals, which were the most carbohydrate heavy, and were followed by the most sedentary time,” Dr Reynolds says.' -- Dr. Andrew Reynolds is one of the authors of the study linked in this article. Another way to improve blood sugar #'s is to find nutrient filled ways to eat that combines lower glycemic carbohydrates with healthy fats and moderate proteins. I believe this small step (pun intended) of going for a walk after meals is a way to stay in better control of diabetes by giving a diabetic a chance to take less medication for their condition. Slowly but surely, the idea that a type 2 diabetic can reduce and eliminate the need for medication is gaining momentum. HealthyAssets.org will provide more specific information as to HOW diabetes can be controlled better and WHAT can be done to make better health a reality.. If you would like to visit sites that may provide valuable information for diabetics please visit the sites below:: https://www.dietdoctor.com/ www.ifm.org/about/profile/jason-fung-md/ https://www.virtahealth.com/ https://www.mooreprevention.com/new-blog/2018/2/17/type-2-diabetes-can-be-reversed https://www.mooreprevention.com/new-blog/2018/2/18/type-2-diabetes-can-be-reversed-part-2-macronutrients-the-role-they-play Understand that I am not a doctor, and the information on this page is for research purposes only. Please consult with your doctor, medical and nutritional team before making any decision that can impact your health. * Carbohydrates affect on bodies are not the same. Some carbs have more nutrients and fiber to help slow your blood sugar rising than other carbs may cause your blood sugar to rise. For a good overview of this issue please visit: www.hsph.harvard.edu/nutritionsource/carbohydrates/carbohydrates-and-blood-sugar/#ref2 From the linked article: 'Dividing carbohydrates into simple and complex, however, does not account for the effect of carbohydrates on blood sugar and chronic diseases. To explain how different kinds of carbohydrate-rich foods directly affect blood sugar, the glycemic index was developed and is considered a better way of categorizing carbohydrates, especially starchy foods. The glycemic index ranks carbohydrates on a scale from 0 to 100 based on how quickly and how much they raise blood sugar levels after eating. Foods with a high glycemic index, like white bread, are rapidly digested and cause substantial fluctuations in blood sugar. Foods with a low glycemic index, like whole oats, are digested more slowly, prompting a more gradual rise in blood sugar.'

0 Comments

Not so fast! Usually when bank executives and politicians want consumers to spend more they suggest people should use their tax refunds, work bonuses or savings. This time home equity is the source being suggested to boost the economy.

That suggestion is an incomplete half measure. Consumer spending is not a magic pill that fixes the economy, especially when the people doing the spending goes deeper in debt or uses all of their savings or equity. The solution to a healthier economy lies in what puts more money into potential consumers hands to begin with:

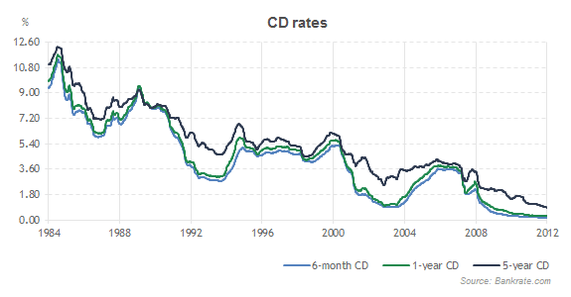

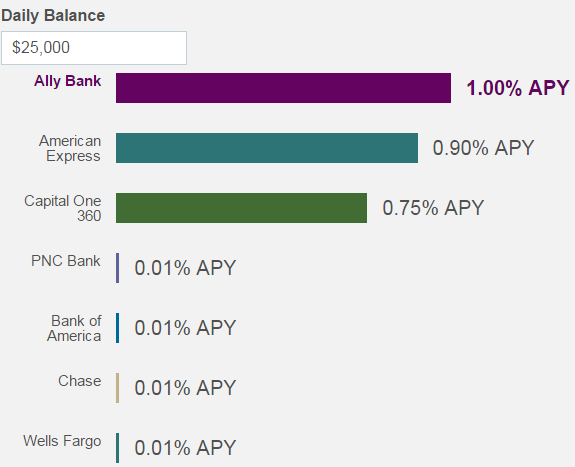

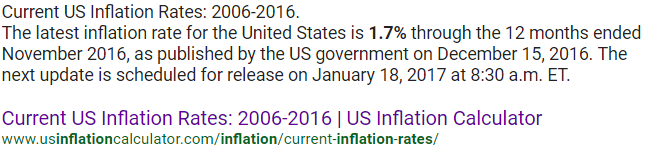

“Make no mistake. Tax, regulatory, government spending and other governmental performance and cost measures matter state by state. They have real impacts not only on entrepreneurship, investment, small businesses and their workers, but naturally therefore on the overall economy of each state,” said Raymond Keating, chief economist of the Small Business & Entrepreneurship Council. Home equity should be used as the homeowner sees fit when managing their own lifestyle. It shouldn't automatically be used to prop up the quarterly #'s of a retail store. Mainstream finance news should focus more on actions that put money into the bank accounts of people, not what takes it away. --Ricky Moore 1. Low Interest Rates & Higher Inflation Rates = Bad ComboLow rates have been hurting savers for the past 8 years as this NY Times article published in 2010 points out: 'Because of persistent low interest rates, anyone looking for decent returns that are also safe has had a tough time this year. Most of the best savings accounts, for instance, don’t even top a 1.5 percent annual yield.' '...the earnings on your savings may not be keeping up with real-life inflation, the kind that includes rapidly increasing health care and other expenses that older people bear the most. And even if you aren’t paying higher prices, it’s still disappointing to earn so little on money you want to be there when you need it.''  The historical safe havens to watch your money grow such as savings and CD accounts have become irrelevant these past few years. CD rates now hover around 1 %, down drastically from the over 10% rates in the mid-1980's. While the popular Ally Savings bank shows how their low 1% savings rate is still better than the competition. Even people who have over $10,000 in low rated savings accounts are frustrated. Their savings, along with everybody else's barely keeps up with the inflation as recorded by the Bureau of Labor Statistics. Simple math will tell you that if your savings rate is lower than the official inflation rate then you are losing the purchasing power of your money. This is because the rate that your money is compounding interest is slower than the rate your money is losing value or slower than the rate of rising prices. How can a Single Premium Life Policy Help Me Fight Low Interest Rates and Inflation?I suggest to interested and potential clients that their single premium should be an amount that they know that they do not need for everyday living expenses. This amount can come from savings, IRA's, CD's, mutual funds, etc. Basically, any amount that doesn't hurt or lower the kind of lifestyle they are currently living. The following 3 examples offer a range of the cash benefit amounts one can expect to have with one of the companies I represent, Foresters Financial. 55 Year Old Non Smoking Female

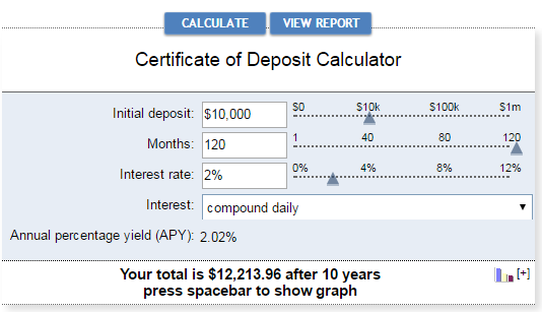

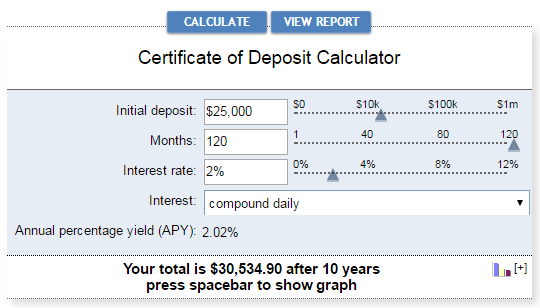

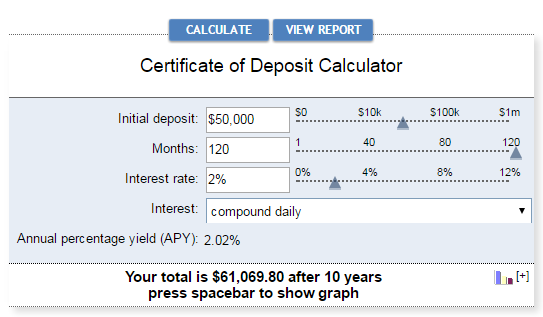

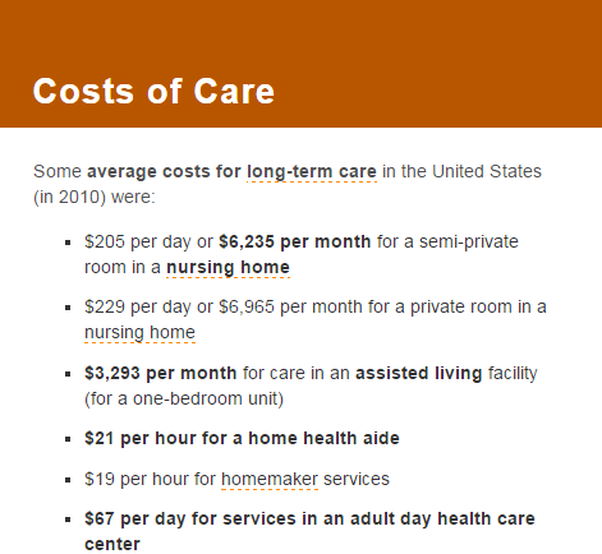

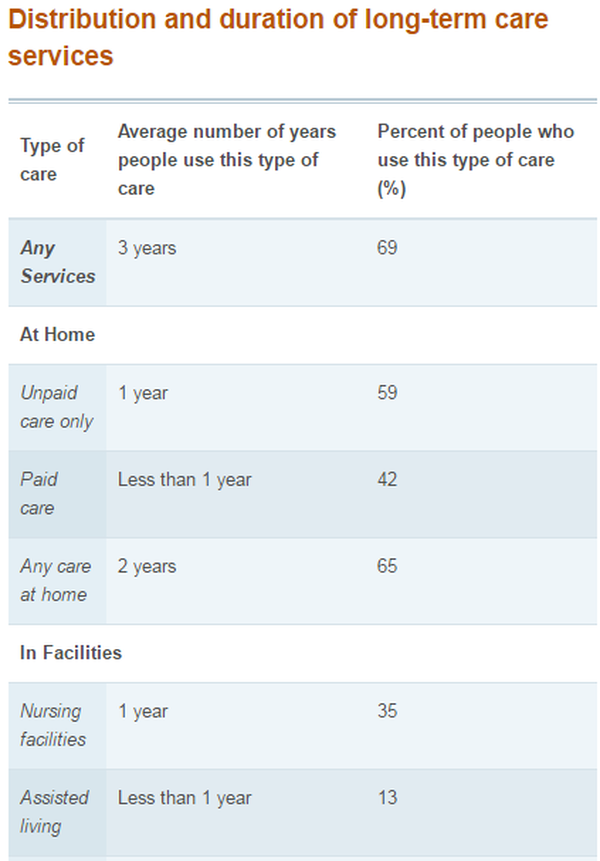

Here is how a CD (Certificate of Deposit) compares using the same single premium figures above. It would literally take decades for your CD to match the same cash value benefit as your single premium life policy. I used a 2% CD interest rate for this example which is higher than the average CD rate currently on the market. Your single premium cash benefit is available to use for emergencies such as critical and chronic illness needs such as long term medical care. If you never need long term medical care, your increased cash benefit can be taken out as a loan or left with your beneficiaries. Your one time premium will have gone much farther and have greater value for you and your family than if it was kept in a low interest rate that can barely keep up with inflation.  Robert Raymond Robert Raymond A very informative article from The San Diego Union Tribune covers how older couple couples have to deal with the sudden shock of needing long term care and the difficulties to pay for such care. Here is an excerpt from this article written by Michele Parente, highlighting Robert Raymond's situation: “We didn’t end up this way being careless, blowing all our money at the casino,” Robert said, sitting in a small studio apartment stacked with boxes filled with the couple’s possessions. “I’m sure I’m not unique in my age group of people getting old and getting wiped out.” In fact, the Raymonds’ financial downfall from middle-class retirees to destitute seniors is all too common. Long-term care, whether in the home, at an assisted living community or at a nursing home, is overwhelmingly paid out-of-pocket, from people’s savings. And multiple studies conducted in recent years all come to the same conclusion: America’s rapidly aging population is ill-prepared to pay for what’s coming. Most long term care isn't covered by Medicare and Medicaid only provides assistance until after you have already spent most of your savings. How can a Single Premium Life Policy Protect My Savings From Long Term Care Expenses?To better answer that question you should know the costs involved with Long Term Care expenses and exactly how long term care is defined: Long Term Care Definition from ElderLawAnswers.com --. Most long-term care involves assisting with basic personal needs rather than providing medical care. The long-term care community measures personal needs by looking at whether an individual requires help with six basic activities that most people do every day without assistance, called activities of daily living (ADLs). ADLs are important to understand because they are used to gauge an individual’s level of functioning, which in turn determines whether the individual qualifies for assistance like Medicaid or has triggered long-term care insurance coverage. The six ADLs are generally recognized as:

Most insurance companies have it written into policy contracts that benefits will be paid when the insured cannot perform at least 2 of the 6 ADLs. So back in 2010 staying in a nursing home for 12 months would cost you $74,820 on average. Staying in an assisted living facility (one bedroom) for 12 months could cost you $39,516. If we use the same single premium examples of the 55 year old non-smoking female (we'll call her Rosemary) from earlier then a $25,000 premium would be all she would need to handle a year in an assisted living facility. The benefit from Rosemary's $25,000 premium ($57,533) would cover the $39,516 assisted living costs and still leave her with a substantial amount to spare. If Rosemary needed to live in a nursing home for a year then the benefit from her $50,000 premium ($115,065) would cover the $74,820 expense with tens of thousands to spare. The extra savings would stay in Rosemary's policy and can be transferred to her beneficiaries income tax free. These are much better options than paying for care out of pocket with no financial protection. 3. Single Premium Life Policies Offers Better Tax AdvantagesYou already know that your savings and CD accounts are not giving you a substantial return of your money with low interest rates hovering around 1%. There is also the fact that interest earned on your savings and CD accounts is considered taxable income by the IRS. If you are in the 25 % tax bracket and your savings or CD earned $250, you will be taxed $62.50 from those earnings. CD's can be protected from tax penalties somewhat if they are placed within a tax deferred IRA. However in my opinion the tax advantages of a single premium life policy far outweigh those of an IRA. For Example: God forbid you are in a situation where you do need long term medical care, your single premium life policy benefits can be withdrawn to pay for your medical care without any tax penalties. If you never need long term care then your increased cash value benefit can be placed with your beneficiaries with no income tax penalties at all. Consider How Your Money Can Be Used to Value You and Your Family the Most...If you are an active real estate investor or you use your capital to invest in businesses that consistently gives you measurable profits then I can understand that a single premium life policy might not be the best choice to place your money. Even though it would still be a respectable option in those cases.

However, if you spent all of your working life placing money aside to save and you are not happy with the returns your savings account has given you then I suggest you send me an email or call me to go over the benefits of a single premium life policy in more detail to see if it fits your individual needs. If you like the concept of everything described in this article but would prefer to make smaller monthly or annual premiums then I would be happy to discuss those options for you as well. To your physical, mental, spiritual and financial well being, Ricky Moore 240-644-4376 info@healthyassets.org

The answer to that question will always be what you feel is best for you.

Here are some questions you can ask yourself to help you decide:

|

|

Term Life Definition:

Life insurance that pays a benefit in the event of the death of the insured during a specified term. Usually the least expensive type of insurance policy because your premiums aren't used to grow cash value. Benefits are only given to you or your beneficiaries during the length of the term period. If you out live the term period (5, 10, 15 20 years or more) then the benefit no longer applies. However you can receive all of your money back that went into premium payments if you chose to have a Return of Premium (ROP) rider. Younger adults usually purchase term life because:

|

Whole Life Definition:

Life insurance that pays a benefit on the death of the insured and also accumulates a cash value. Whole life insurance is usually the preferred choice because people want their premiums to grow cash value that they can use for future life emergencies or just to have on hand. Because whole life policies grow cash value the premiums are more expensive than term life premiums. Most experts will tell you a whole life policy is a great option if you don't do anything else to receive extra cash flow throughout your life. Savings rates have never been lower and if you don't have an extra source of income, such as a side business or cash flow from investments then a whole life policy is a good way to earn cash value from your premiums as well as having a substantial cash accident or death benefit. |

Universal Life Definition:

Universal life insurance is a type of flexible permanent life insurance offering the low-cost protection of term life insurance as well as a savings element (like whole life insurance), which is invested to provide a cash value buildup.

Universal Life premiums are tied to the stock market so if your premiums are invested in rising stock markets you can have a higher cash benefit for your insurance policy.

On the other hand if the stock market falls, the insurance company will limit the loss exposure to you. In other words, the value of your universal life insurance policy would never be lower than the contracted guaranteed minimum benefit amount.

Universal life insurance is a type of flexible permanent life insurance offering the low-cost protection of term life insurance as well as a savings element (like whole life insurance), which is invested to provide a cash value buildup.

Universal Life premiums are tied to the stock market so if your premiums are invested in rising stock markets you can have a higher cash benefit for your insurance policy.

On the other hand if the stock market falls, the insurance company will limit the loss exposure to you. In other words, the value of your universal life insurance policy would never be lower than the contracted guaranteed minimum benefit amount.

How Does an Insurance Company pay larger benefits of up to $250,000 or more?

A life insurance company pools the premiums they receive from their clients and they place these premiums into what are considered safe investments.

The reason why Mary, a 40-year-old, non-smoking female can get a $250,000 cash benefit amount paying $99 a month is because her life insurance company has calculated how soon they would have to pay this benefit to Mary.

Her insurance company has pooled her premiums with others in similar life situations as Mary's. Based on demographics, health history, lifestyles and past records, insurance companies calculate the average life expectancies of all their clients.

Insurance companies hire people trained at figuring out the profit they will receive from investing paid premiums of their clients and how substantial of a cash benefit they can give back to the client based on the clients average lifespan and past medical history.

In other words, with a group of a thousand 40 something year old non-smoking females, insurance companies know how much profit they will receive from premiums invested before they have to pay the contracted benefit amounts to the insured.

The blunt truth is that if 1 or 2 clients pass away several months apart 20 years from now it likely won't hurt the insurance company financially.

This is the major reason why life insurance companies will not cover natural disasters like floods or earthquakes because there is a higher possibility that more of their clients will die at the same time causing a huge financial loss to the insurance company.

That sounds like a cold thing to say but insurance companies have to make sure they can pay their clients back the promised benefits without going out of business.

Simple Math: Is The Cash Benefit I Would Get Worth The Insurance Premiums I would Pay?

|

|

When I see a person or a couple interested in life insurance information, I ask them: Why do they think they may need life insurance?

The typical answer is 'I want my wife (husband or children) to be financially protected in case I am no longer around or I can't work.' |

Some people live paycheck to paycheck and haven't set money aside for important purchases while others have plenty of savings and investments to use towards a life insurance policy.

There is no 'one size fits all' answer here. Insurance companies offer a range of benefits, the bottom line is most people are interested in how much can their family benefit and is that benefit worth the premiums paid?

There is no 'one size fits all' answer here. Insurance companies offer a range of benefits, the bottom line is most people are interested in how much can their family benefit and is that benefit worth the premiums paid?

So Do I Need Life Insurance?

Not everybody NEEDS life insurance but I believe it is a nice benefit to have as a bonus for some, if not, most people.

For others, especially those that live paycheck to paycheck with very little savings, it is more important that you consider life insurance as a form of financial protection for you and your family.

Consider if you can comfortably set aside money for premiums. Then figure out all the details of the benefits you can get with your paid premiums.

An insurance policy is not meant to be a get rich quick plan. It is meant to be used as protection, your beneficiaries can use the cash benefit to better themselves and pursue their goals and dreams, they can use the cash benefit to help them go to college or become an entrepreneur and build a business.

However the cash benefit to your beneficiary is primarily meant to help them live the life they are used to when you were around.

For others, especially those that live paycheck to paycheck with very little savings, it is more important that you consider life insurance as a form of financial protection for you and your family.

Consider if you can comfortably set aside money for premiums. Then figure out all the details of the benefits you can get with your paid premiums.

An insurance policy is not meant to be a get rich quick plan. It is meant to be used as protection, your beneficiaries can use the cash benefit to better themselves and pursue their goals and dreams, they can use the cash benefit to help them go to college or become an entrepreneur and build a business.

However the cash benefit to your beneficiary is primarily meant to help them live the life they are used to when you were around.

For More Information Contact Me...

I am licensed to sell life insurance in New York, Pennsylvania, Maryland, Virginia and South Carolina and I visit each of these states frequently.

If I am not in your local area then I can refer you to a trusted professional that can give you the information you need to make an informed decision.

Happy New Year! May your choices bring you satisfaction in your life!

Contact me with your questions or to setup an appointment:

Ricky Moore

retirementbenefitsinto@gmail.com

240-644-4376 (Cell Phone)

If I am not in your local area then I can refer you to a trusted professional that can give you the information you need to make an informed decision.

Happy New Year! May your choices bring you satisfaction in your life!

Contact me with your questions or to setup an appointment:

Ricky Moore

retirementbenefitsinto@gmail.com

240-644-4376 (Cell Phone)

Here Is Some General Information From The 2 Most Accepted Insurance Company Policies That I Sell

Foresters Financial

|

|

|

United Home Life

(Not Available in New York)

Coverage for Insulin Dependent Diabetics

Ricky Moore

240-644-4376 (Cell #)

retirementbenefitsinfo@gmail.com

On November 30, 2016, ZeroHedge.com posted information on their site about how the Dallas Police and Firefighters Pension (DPFP) Board:

'discovered that one of their real estate managers had been consistently overmarking illiquid real estate investments. That discovery resulted in an FBI investigation of the manager and a $1BN write down for the DPFP. In the wake of the writedowns, Dallas policemen and firefighters rushed for the exits and withdrew over $500mm in assets.

Fearing a "run on the bank" that could push the whole city of Dallas into bankruptcy, Mayor Mike Rawlings has just sent a scathing letter to the DPFP Pension Board demanded that withdrawals be halted immediately until the "solvency and actuarial soundness of the Pension System is restored."'

'discovered that one of their real estate managers had been consistently overmarking illiquid real estate investments. That discovery resulted in an FBI investigation of the manager and a $1BN write down for the DPFP. In the wake of the writedowns, Dallas policemen and firefighters rushed for the exits and withdrew over $500mm in assets.

Fearing a "run on the bank" that could push the whole city of Dallas into bankruptcy, Mayor Mike Rawlings has just sent a scathing letter to the DPFP Pension Board demanded that withdrawals be halted immediately until the "solvency and actuarial soundness of the Pension System is restored."'

While this story just seems to be about alleged abuse and mismanagement of funds, there are questions that should be asked whenever a financial committment might be made

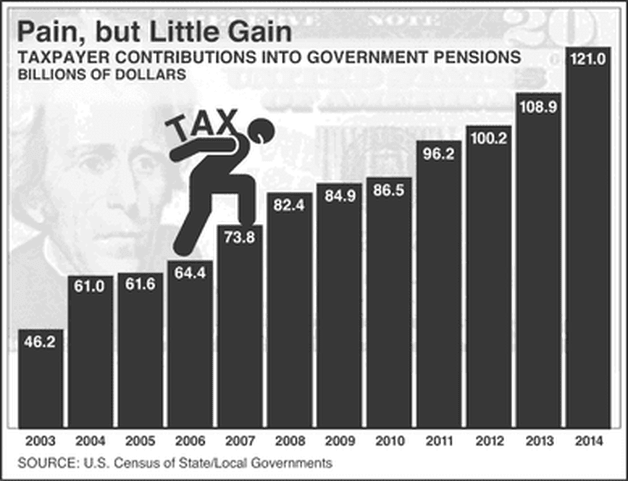

- Just how reliable is a pension in today's economy that is propped up by our central bank's financial tricks?

- Should pensions be considered as a reliable option to fund retirement after your working days are behind you?

These police officers and firefighters were promised an 8% return. In today's economy, that figure for a typical pension should be a red flag for the cautious and aware:

- How did the investment advisor plan on this pension paying 8% annual returns throughout retirement?

- What process led to these high returns?

- Are these high returns likely in an economy that hasn't gained traction for close to a decade?

More Pension Issue Stories to Come...

I believe that in the next few years there will be more stories of pensions not living up to contractual promises.

Our current economy is propped up more by financial tricks and games than it is by tried and true economic principles of savings, smart loan choices and real business development that hires more people and brings quality of life choices to consumers through market competition.

If investment choices aren't based on real world growth and production then what exactly are they based on?

It seems fraud and deceit brought down the pensions of the Dallas firefighters and police officers discussed in the ZeroHedge article linked above.

- How many pensions out there now that have the same fraudulent issues that haven't been exposed yet?

- How many pensions can survive without being indirectly influenced by our central bank's policy decisions that consistently adds more debt and provides an increase in 'paper value' only to be bailed out by taxpayers when that paper value is reduced dramatically under the reality of economic fundamentals?

Bottom line: watch your pensions as if your retirement life depends on it because it likely will for most peeple.

UPDATE:

It should serve as a wake up call that legistration is being drafted that would require Dallas policeman and firefighters to payback some of their pension benefits.

Just as former pension board trustee, Lee Kleinman says in the video above:

''Well I think it was unfair that they (pensioners) were made those promises in the first place. That was what was wrong.'

Benefit plans should be based on real value that you can see and say 'Here is proof why my investment / pension / stock, etc. is making money.

Taking the word of a financial manager is not enough to feel good about an investment.

As always, proactive due diligence can save your finances from harm.

Taking the word of a financial manager is not enough to feel good about an investment.

As always, proactive due diligence can save your finances from harm.

Ricky Moore

Independent Asset Management Agent

Independent Asset Management Agent

Yesterday in the 'News' section of HealthyAssets.org, I linked to an NPR article covering how people aren't happy with their health insurance premiums that are set to rise yet again in 2017.

Some of the examples NPR listed were:

Humana in Georgia = 67.5 % premium hike.

BlueCross BlueShield of Tennessee = 62 % premium hike.

Seven insurers on the individual market in Minnesota are raising premiums = 50 to 67 percent

Affordable Care Act premiums in Florida = 19 % premium hike.

Some of the examples NPR listed were:

Humana in Georgia = 67.5 % premium hike.

BlueCross BlueShield of Tennessee = 62 % premium hike.

Seven insurers on the individual market in Minnesota are raising premiums = 50 to 67 percent

Affordable Care Act premiums in Florida = 19 % premium hike.

This has become an annual tradition with most of the big name health insurance companies as they have increased their rates in the past before.

The same NPR article explained one reason for the higher premiums:

'While consumers have faced sticker shock, the insurers have faced what might be called "sicker shock." They are raising premiums after finding that many of the customers buying plans on the individual market were sicker and more costly to insure than expected when the health law was implemented.'

True. If more people with current healthcare needs are enrolled then more money will be spent by insurance companies than they expected and premiums would be raised to cover their costs... and cover the profit margins they are used to.

Another reason to consider is that the entire healthcare insurance model is seriously flawed.

For starters, health insurance companies that increase their premiums are too much involved in the decision making process regarding the care their customers can receive.

In addition, a lot of the service options provided by insurance companies doesn't fit the true definition of insurance.

When it comes to the big name health insurance companies there is a profit motive for them that goes far beyond the best interests of their customers.

What should be a direct doctor/patient relationship is often hijacked by an insurance company whose involvement can increase prescriptions prices and dramatically raise the cost of surgeries.

The $100 Asprin

You may have heard the stories about ridiculously high prices many big chain hospitals have charged for an aspirin pill.

Dr. Keith Smith of the Surgery Center of Oklahoma explains the details covering the relationship hospitals have with insurance companies when it comes to prices.

Dr. Keith Smith of the Surgery Center of Oklahoma explains the details covering the relationship hospitals have with insurance companies when it comes to prices.

| | | |

Collusion to raise prices isn't insurance.

Insurance is a contract, represented by a policy, in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients' risks to make payments more affordable for the insured. --investopedia.com

This specifically applies to circumstances that a person couldn't financially handle on their own.

This specifically applies to circumstances that a person couldn't financially handle on their own.

There is car insurance for car accidents, there is home insurance for fire or theft. These are examples where insurance is meant to cover costs so you can maintain or get back to the same quality of life you enjoyed before you had an accident or experienced an unfortunate incident.

In the case of healthcare, insurance is meant to pay for catastrophic issues that can be addressed without bankrupting your family. Catastrophic issues such as a physical illness or an accident that can cause you to miss work for months or years qualifies as something that insurance should cover.

Paying $100 for aspirins that cost pennies to make shouldn't qualify as an insurance service, but it does and that is part of our current healthcare problem.

In the case of healthcare, insurance is meant to pay for catastrophic issues that can be addressed without bankrupting your family. Catastrophic issues such as a physical illness or an accident that can cause you to miss work for months or years qualifies as something that insurance should cover.

Paying $100 for aspirins that cost pennies to make shouldn't qualify as an insurance service, but it does and that is part of our current healthcare problem.

A More Efficient Healthcare Model

It is a fact that your choices are limited by the service options your insurance company will approve. If you were to remove the 3rd party insurance company out of the way then now the door is open to a more direct relationship with your doctor where all options to your care can be discussed and you can decide which route you want to take.

The cost of your care can go down dramatically as well now that your insurance company isn't involved with every single decision.

The cost of your care can go down dramatically as well now that your insurance company isn't involved with every single decision.

Patients of Health Suite 110 pay what they see as an affordable monthly fee which gives them tremendous access to their physician while receiving discounts on a variety of services. Discounted imaging, labs and medications can help these patients lower their monthly premiums by having their insurance company cover only bigger, more pertinent, catastrophic events.

Atlas.MD helps their patients reduce their insurance premiums by 60 %

Dr. Josh Umbehr of Atlas.MD explaining the advantages of a Direct Primary Care model

Dr. Josh Umbehr of Atlas.MD explaining the advantages of a Direct Primary Care model Dr. Josh Umbehr of Atlas.MD was my first introduction to the Direct Primary Care model.

Atlas.MD has saved families and employers up to 60% on their insurance costs because they provide their patients with services that no longer need to be covered by their insurance companies. Again, for a monthly fee, patients have much more control of the care they receive and they can now readjust their health insurance policies to reflect the reduction of services their insurance would now provide.

Atlas.MD has saved families and employers up to 60% on their insurance costs because they provide their patients with services that no longer need to be covered by their insurance companies. Again, for a monthly fee, patients have much more control of the care they receive and they can now readjust their health insurance policies to reflect the reduction of services their insurance would now provide.

The Surgery Center of Oklahoma helped save Oklahoma County $1.7 Million

As I mentioned in my article about Dr. Keith Smith and the Surgery Center of Oklahoma, by not dealing with insurance companies whose involvement insanely drives up the price of surgeries, Dr. Smith's facility is able to offer dramatically reduced prices for his medical care.

How does he do this?

He only charges for his time and the cost to do the surgery.

Simple and direct.

No insurance company needed to negotiate a higher charge, no inflated overhead costs to pay staff workers to shuffle papers along and not have any direct impact delivering care to the patient.

At Dr. Smith's facility it is now common to see savings anywhere from $5,000 to over $20,000 per surgery compared to what big chain hospitals charge for the same procedure.

This surgery center has also saved Oklahoma County 'at least $1.7 million in insurance outlays and an estimated $250,000 in patient copays.' -- JournalRecord.com

How does he do this?

He only charges for his time and the cost to do the surgery.

Simple and direct.

No insurance company needed to negotiate a higher charge, no inflated overhead costs to pay staff workers to shuffle papers along and not have any direct impact delivering care to the patient.

At Dr. Smith's facility it is now common to see savings anywhere from $5,000 to over $20,000 per surgery compared to what big chain hospitals charge for the same procedure.

This surgery center has also saved Oklahoma County 'at least $1.7 million in insurance outlays and an estimated $250,000 in patient copays.' -- JournalRecord.com

All of this is possible by eliminating the need of third parties and bureaucracies, both of which are completely synonymous with insurance companies.

These are real world examples of healthcare services being provided to patients at lower costs, quite the contrast to the neverending stories of insurance companies seeking and receiving premium increases that their increasingly frustrated customer base pays.

Insurance is a simple contract. 'I pay premiums, if such and such happens, my insurance company will give me _______.'

It is when insurance companies act outside the scope of their definitive responsibilities that the door is now open to rising costs for patients. Using insurance to cover an office visit or paying for highly inflated prescription costs is not true insurance. As long as we have this kind of system healthcare will continue to be expensive.

What is needed is true freedom of choice for a patient to discuss care options with a doctor he/she is comfortable with.

Regarding choices, there needs to be market competition where a person can determine who provides the best value to deliver their healthcare needs. This means insurance companies would not get any favors from the government restricting market competition and ultimately driving up costs.

It is when insurance companies act outside the scope of their definitive responsibilities that the door is now open to rising costs for patients. Using insurance to cover an office visit or paying for highly inflated prescription costs is not true insurance. As long as we have this kind of system healthcare will continue to be expensive.

What is needed is true freedom of choice for a patient to discuss care options with a doctor he/she is comfortable with.

Regarding choices, there needs to be market competition where a person can determine who provides the best value to deliver their healthcare needs. This means insurance companies would not get any favors from the government restricting market competition and ultimately driving up costs.

Price Transparency: A Growing Trend in Healthcare?

The cost of care is clearly known and the patient determines if they want to pay for such care.

There are organizations out there that promotes the idea of having a simple doctor / patient relationship.

The Free Market Medical Association in particular is one that I am very familiar with. This association was formed by Dr. Keith Smith of the Surgery Center of Oklahoma and J. Kempton Jr. of The Kempton Group, a facilitator for providing savings to employers and their employees through self-funded plans.

Just as Dr. Smith and the independent doctors at the Surgery Center of Oklahoma have saved Oklahoma County millions of dollars, The Kemption Group has helped employers throughout the years save millions on the healthcare needs of their employees. The passion of these two men to provide value, high quality care and savings to their patients and clients is what drove the Free Market Medical Association to be created.

This organization is comprised of medical professionals and professionals in other fields, all who believe in a more efficient model of healthcare. You may not be able to tell based on the articles I write about insurance companies but I am a life insurance agent. However, I believe my clients need to be aware of the options they have to preserve their assets. What better way to preserve their assets by showing them that they do not have to spend grossly inflated costs on healthcare that reduces or potentially eliminates their savings?

There are organizations out there that promotes the idea of having a simple doctor / patient relationship.

The Free Market Medical Association in particular is one that I am very familiar with. This association was formed by Dr. Keith Smith of the Surgery Center of Oklahoma and J. Kempton Jr. of The Kempton Group, a facilitator for providing savings to employers and their employees through self-funded plans.

Just as Dr. Smith and the independent doctors at the Surgery Center of Oklahoma have saved Oklahoma County millions of dollars, The Kemption Group has helped employers throughout the years save millions on the healthcare needs of their employees. The passion of these two men to provide value, high quality care and savings to their patients and clients is what drove the Free Market Medical Association to be created.

This organization is comprised of medical professionals and professionals in other fields, all who believe in a more efficient model of healthcare. You may not be able to tell based on the articles I write about insurance companies but I am a life insurance agent. However, I believe my clients need to be aware of the options they have to preserve their assets. What better way to preserve their assets by showing them that they do not have to spend grossly inflated costs on healthcare that reduces or potentially eliminates their savings?

If you are interested in getting a better understanding of how you can take control of your healthcare and only use insurance companies for the potential emergencies in life then please visit FMMA.org, if you are on Facebook, look up and 'Like' the following:

The Surgery Center of Oklahoma

Atlas.MD

Health Suite 110

The Wedge of Health Freedom

Zarephath Health Center

Free Market Medical Association

The Surgery Center of Oklahoma

Atlas.MD

Health Suite 110

The Wedge of Health Freedom

Zarephath Health Center

Free Market Medical Association

To your health,

Ricky Moore

Ricky Moore

Have you ever noticed that the stock market seems to have a record high at least once a month? Meanwhile your day to day activities doesn't reflect the financial euphoria felt by Wall Street.

Rising stock market values has less to do with the real world economy with each passing year.

Instead, stock market values frequently rise as a result of Wall St techniques that can raise a company's stock price independently from what is actually going on in the economy.

Besides Wall St. tricks, the Federal Reserve also has the ability to prop up the stock market during times when the economy can easily improve.

Rising stock market values has less to do with the real world economy with each passing year.

Instead, stock market values frequently rise as a result of Wall St techniques that can raise a company's stock price independently from what is actually going on in the economy.

Besides Wall St. tricks, the Federal Reserve also has the ability to prop up the stock market during times when the economy can easily improve.

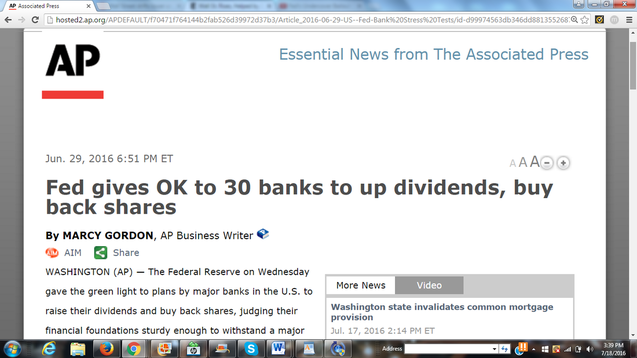

Share Buy Back / Repurchasing Stocks

One option a company will take to boost it's stock price is to repurchase it's own shares.

Generally speaking, a company's bottom line is creating a profit and raising value for it's shareholders. Whether or not a company is satisfying consumer demand is not relevant when it comes to buying back their own stock.

Here are a few things I consider when I think of a good economy:

These questions aren't answered when a company has just repurchased it's own stock to give the appearance of a higher stock value.

Here are a few things I consider when I think of a good economy:

- Do people have a stable and rising income over time?

- Do people have the ability to save money to use for future goals in their lives?

- Can employers maintain their employee base or add to it to make sure consumer demand is reached?

- Are prices for important everyday purchases going down or up?

These questions aren't answered when a company has just repurchased it's own stock to give the appearance of a higher stock value.

Big Banks Buy Back Their Own Stocks Also

From the AP article shown above:

- 'Morgan Stanley's plan only got conditional approval and it has until the end of the year to revise it. But the Wall Street institution was still allowed to return profits to shareholders, and it quickly announced plans to buy back up to $3.5 billion worth of its stock and to boost its dividend 33 percent.'

- 'A number of banks quickly jumped in with announcements of share buyback plans. They included Bank of America ($5 billion) and Citigroup (up to $8.6 billion).'

Bank of America, Citigroup and JP Morgan Chase bought back up to roughly $17 Billion in stock shares.

That looks good for Wall St reports but doesn't change much for your typical everyday worker and saver.

Stock buybacks are common and have increased in the past few years.

Apple does it.

(Excerpt) 'Although its growth rate is slowing, Apple generates huge amounts of free cash flow. This allows it to continue rewarding shareholders with increasing cash returns, including dividends and stock buybacks.'

The TV station CBS does it.

(Excerpt) 'The announcement comes as some analysts question whether the broadcaster can continue to show the kind of growth that fueled a nearly 15% growth in its stock price so far in 2016. For example, this month UBS Global Research’s Doug Mitchelson downgraded CBS to “sell,” saying he believes TV advertising will lose steam after the Olympics.'

Home Depot seems to be experts at stock buy backs.

(Excerpt) 'So, investors are piling into Home Depot thinking it's a safe place to ride out the recent market volatility. But ironically, they are paying a near-historic multiple for a stock that is being driven by stock buybacks -- financed by debt that will probably become more expensive later this month. Good luck with that.'

That looks good for Wall St reports but doesn't change much for your typical everyday worker and saver.

Stock buybacks are common and have increased in the past few years.

Apple does it.

(Excerpt) 'Although its growth rate is slowing, Apple generates huge amounts of free cash flow. This allows it to continue rewarding shareholders with increasing cash returns, including dividends and stock buybacks.'

The TV station CBS does it.

(Excerpt) 'The announcement comes as some analysts question whether the broadcaster can continue to show the kind of growth that fueled a nearly 15% growth in its stock price so far in 2016. For example, this month UBS Global Research’s Doug Mitchelson downgraded CBS to “sell,” saying he believes TV advertising will lose steam after the Olympics.'

Home Depot seems to be experts at stock buy backs.

(Excerpt) 'So, investors are piling into Home Depot thinking it's a safe place to ride out the recent market volatility. But ironically, they are paying a near-historic multiple for a stock that is being driven by stock buybacks -- financed by debt that will probably become more expensive later this month. Good luck with that.'

I am not commenting on the efficacy of 'stock buybacks' as an investing strategy. Instead, I am making the observation that the financial media places too much importance on a company's stock quote when they claim the economy is strong and healthy.

A company can raise it's stock market value regardless of whether or not they are meeting consumer demand or creating a profit from their day to day activities.

A company can raise it's stock market value regardless of whether or not they are meeting consumer demand or creating a profit from their day to day activities.

Investors used to pay more attention to real world economic and business signals, they use to put more emphasis on the details of a company's balance sheet before making investment decisions.

Now, instead of real world data, investors wait to see what the Federal Reserve (America's Central Bank) will do.

This NY Times article shows how Wall St. investors will slow down stock market activity until they find out if the Federal Reserve has changed policies regarding interest rates or the creation of new money into the market:

'John Canally, an investment strategist at LPL Financial, expects the market to coast until the Federal Reserve meets next week.

"Basically, we're in a waiting period for the Fed," he said. "Today is probably what you can expect for the rest of the week: a lack of direction."'

Definitely a lack of direction. Rather than looking at a business's ability to efficiently meet consumer demand, among other economic fundamentals. Investors now wait for the Federal Reserve to report if their 'easy money' policies will continue.

'Easy Money' policies are given fancy names like 'quantitative easing' but in reality it is just another debt scheme.

Now, instead of real world data, investors wait to see what the Federal Reserve (America's Central Bank) will do.

This NY Times article shows how Wall St. investors will slow down stock market activity until they find out if the Federal Reserve has changed policies regarding interest rates or the creation of new money into the market:

'John Canally, an investment strategist at LPL Financial, expects the market to coast until the Federal Reserve meets next week.

"Basically, we're in a waiting period for the Fed," he said. "Today is probably what you can expect for the rest of the week: a lack of direction."'

Definitely a lack of direction. Rather than looking at a business's ability to efficiently meet consumer demand, among other economic fundamentals. Investors now wait for the Federal Reserve to report if their 'easy money' policies will continue.

'Easy Money' policies are given fancy names like 'quantitative easing' but in reality it is just another debt scheme.

Quantitative Easing Explained

From Investopedia.com:

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

In normal language, the Federal Reserve purchases debt (bonds, mortgage backed securities, etc.) from financial institutions like big banks, when the Fed purchases this debt, new money is created as an asset into a bank's bottom line.

The purpose of this new money is to allow the banks to lend more to everyday people looking for loans to start businesses or make important big purchases like buying a home.

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity.

In normal language, the Federal Reserve purchases debt (bonds, mortgage backed securities, etc.) from financial institutions like big banks, when the Fed purchases this debt, new money is created as an asset into a bank's bottom line.

The purpose of this new money is to allow the banks to lend more to everyday people looking for loans to start businesses or make important big purchases like buying a home.

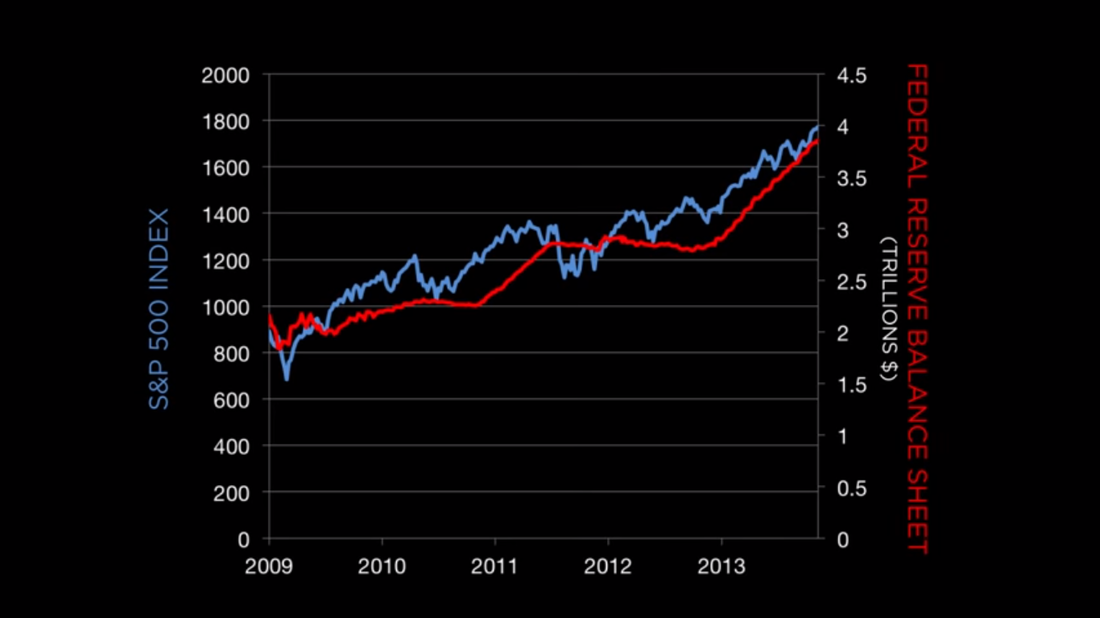

Quantitative Easing / Stock Market Parallel

Looking at the graph above you notice there is a strong correlation between the growth in the S&P 500 Index and the trillions of dollars created by the Federal Reserve.

Another example of rising stock market value that has nothing to do with the satisfaction of consumers buying products or businesses running efficiently. This kind of stock market growth is propped up by the Federal Reserve purchasing debt and placing trillions of dollars into big banks

Another example of rising stock market value that has nothing to do with the satisfaction of consumers buying products or businesses running efficiently. This kind of stock market growth is propped up by the Federal Reserve purchasing debt and placing trillions of dollars into big banks

Of course many banks didn't increase their lending activity to consumers because the Federal Reserve paid them interest on the newly created money which gave banks a positive cash flow. For more on this issue read this Huffington Post article.

If you invest in the stock market you would be wise to do as much of your own research as possible with the understanding that there is more information needed than just a company's stock price or what the Federal Reserve is doing.

- Does a company have a new product coming out that you think will be a hot seller?

- Are you satisfied with a company's management style?

- Does a company consistently meet their quarterly and annual goals based on their own work output and not from Federal Reserve assistance?

- Do consumers have disposable income or a need to pay for a company's product/service?

Researching these kind of questions may help you manage the ups and downs of a stock market whose value is easily manipulated by other factors that has nothing with real productive growth. -- Ricky Moore

Today's current healthcare system in America can limit patients choices for care and blind them to true costs of service.

Instead of having piece of mind on the care they are receiving, many patients have to fight insurance companies about services, costs and innocent coding mistakes that hike up the prices that the patient has to pay.

In addition patients over the years have gotten used to longer waits and shorter visits with their primary care doctor.

Instead of having piece of mind on the care they are receiving, many patients have to fight insurance companies about services, costs and innocent coding mistakes that hike up the prices that the patient has to pay.

In addition patients over the years have gotten used to longer waits and shorter visits with their primary care doctor.

Fortunately there seems to be a growing trend of a more efficient model of patient care, at least in the world of family physician services. This model is referred to as Direct Primary Care.

What Direct Primary Care means is that you and your doctor have a clear, close working relationship with each other free of bureaucracy and 3rd party insurance interference.

What Direct Primary Care means is that you and your doctor have a clear, close working relationship with each other free of bureaucracy and 3rd party insurance interference.

Health Suite 110: A Family Physician Practice that Works With Patients to Provide Excellent Care

Health Suite 110 is a family physician facility located in Kansas, co-founded by Dr. Kylie Vannaman and Dr. Haseeb Ahmed.

With independent practices in the same location, both Dr. Vannaman and Dr. Ahmed's focus is on making sure the patient is comfortable and does not feel rushed to discuss issues regarding their health.

In our traditional healthcare system, many patients feel like they are on a conveyor belt being shuffled from one room to the next. Their ability to get the care they need is limited by what their insurance company is willing to cover.

But if you were to remove the insurance company out of the equation then the doctor and patient can work toward a mutual understanding of the best road to take to maintain the best state of health possible.

What facilities like Healthy Suite 110 prove is that insurance companies aren't needed for many general physician services.

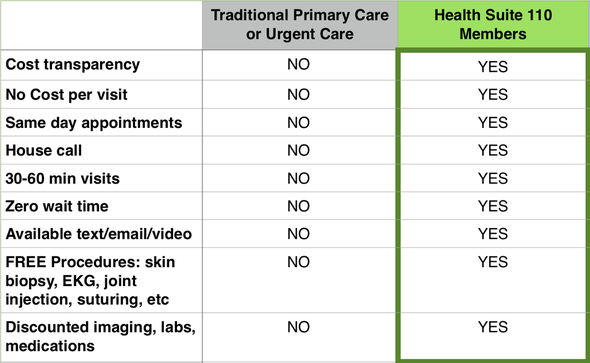

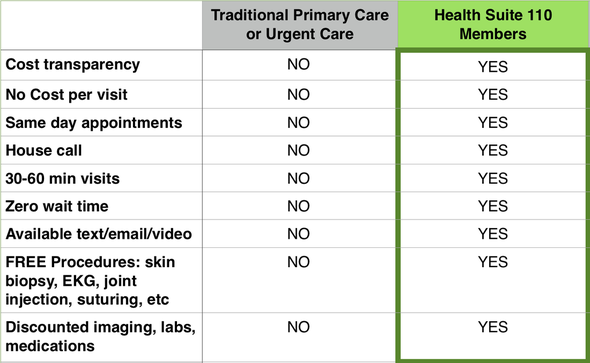

Their patients can substantially reduce their insurance premiums because many services (like those shown below) are already included with their monthly service fee.

With independent practices in the same location, both Dr. Vannaman and Dr. Ahmed's focus is on making sure the patient is comfortable and does not feel rushed to discuss issues regarding their health.

In our traditional healthcare system, many patients feel like they are on a conveyor belt being shuffled from one room to the next. Their ability to get the care they need is limited by what their insurance company is willing to cover.

But if you were to remove the insurance company out of the equation then the doctor and patient can work toward a mutual understanding of the best road to take to maintain the best state of health possible.

What facilities like Healthy Suite 110 prove is that insurance companies aren't needed for many general physician services.

Their patients can substantially reduce their insurance premiums because many services (like those shown below) are already included with their monthly service fee.

Health Suite 110 Patient Services

- 24/7 direct access to your physician via phone, email or text (NO phone trees)

- Unlimited clinic visits, emails, texts, and phone calls

- Same day or next day appointments

- Annual wellness and prevention visit (includes general physical, well-woman exams, school and sports physicals)

- Annual adult flu shot (while supplies last)

- Urgent care (acute illness, injury, etc)

- Chronic care (diabetes, asthma, high blood pressure, etc)

- Extended, relaxed visits

- Discounted medications

- Discounted labs and imaging (X-rays, CT scans, MRI, etc)

- Community education & events

- No co-pays or hidden fees

- In-office procedures as needed, including: EKG, spirometry, mole removal, rapid strep test, urinalysis, urine pregnancy test, laceration repair (stitches), wart treatment, breathing treatments, splinting, skin biopsy, sebaceous cyst removal, joint injections, ingrown toenail treatment, cryotherapy, ear wax removal, pap smears, IUD removals, etc.

- Smaller patient panel to improve coordination of care and communication with the rest of your healthcare team

- If hospitalization is necessary, we are here to coordinate your care, communicate with the hospital team, provide prompt after-hospital care and follow-up.

- Privacy: your health information will not be shared with any third parties (including insurance companies) without your authorization

- Freedom to choose: if you require other services or sub-specialty care, we are free to utilize whomever is in your best interests without limitation to any particular hospital system

- Now that we work directly for you (instead of the insurance company), you have a doctor who has more time to listen, stay up-to-date on medical information and to research issues more thoroughly, thus avoiding unnecessary sub-specialist referrals, testing and overall costs.

- A meaningful relationship with your personal doctor to address prevention & wellness, acute illness and injuries as well as chronic disease management.

Simple and Direct

Patients that visit Health Suite 110 are essentially paying members of a club. It is the job of Dr. Ahmed and Dr. Vannaman to live up to the expectations of their members:

- Their passion to care for patients makes this responsibility a rewarding pursuit for them.

- Their patients don't have to worry about setting up an appointment next week so they can sit in a waiting room and have limited time with their doctor that has many other patients to see.

- Their efforts build trust and stability. Peace of mind can help the healing process in addition to the health services performed.

- A sense of being on the same team. Dr. Ahmed and Dr Vannaman each have their own blog where they share their insights on how to optimize care and efficiently provide solutions for their patients.

Is the Direct Primary Care Model Good for Me?

Everyone is different with their own set of unique circumstances. Here is some information to help you decide if Direct Primary Care is a good option for you, straight from the website of Health Suite 110 co-founder, Dr. Kylie Vannaman.

What you should ask yourself is:

Besides financial benefits, do you feel as if your doctor is in your corner and has your best health interests in mind?

Do your research? A theme on my site is that an informed mind can more easily choose the most efficient and logical solution for themselves.

Dr. Vannaman and Dr. Ahmed are examples of professionals that act on their convictions to provide a high quality of service to their patients. They are trying to remove obstacles away from the patient to receive the best care.

- How satisfied are you with the current setup with your family doctor?

- Does a Direct Primary Care monthly fee with all of their stated benefits provide me with savings to make this worthwhile for me?

- How much could I reduce health insurance premiums if most of my health needs are already being met by a facility such as Health Suite 110?

Besides financial benefits, do you feel as if your doctor is in your corner and has your best health interests in mind?

Do your research? A theme on my site is that an informed mind can more easily choose the most efficient and logical solution for themselves.

Dr. Vannaman and Dr. Ahmed are examples of professionals that act on their convictions to provide a high quality of service to their patients. They are trying to remove obstacles away from the patient to receive the best care.

In today's healthcare climate of rising premiums, limited coverage and lack of price transparency, it is worth your time to see if a direct primary care facility can work for you.

With a proven track record of making the care of their patients their top priority, the doctors at Health Suite 110 will serve as a testament that clear communication and exceeding patients expectations is the norm and not the exception.

With a proven track record of making the care of their patients their top priority, the doctors at Health Suite 110 will serve as a testament that clear communication and exceeding patients expectations is the norm and not the exception.

Health Suite 110

Dr. Haseeb Ahmed

LiveActive Primary Care |

Dr. Kylie VannamanKC Family Doc

|

Happy Fourth of July, exercise your freedom to be in control of your own health care!

Ricky Moore

Independent Asset Management Agent

Independent Asset Management Agent

In the near future I will have a list of direct primary care family physician facilities in as many states as possible.

It's an automatic response for some people to label anyone against Medicaid as being 'anti-poor' people. Those who voice their concerns that Medicaid consumes too much from state and federal budgets is considered to favor the 1% over the working class or the unemployed.

What if there were 2 people, a married couple, that were not only against the idea of Medicaid, but they also took action to reduce what they felt were the disastrous effects of this government program for the poor?

What if there were 2 people, a married couple, that were not only against the idea of Medicaid, but they also took action to reduce what they felt were the disastrous effects of this government program for the poor?

Introducing The Zarephath Health Center

Drs. John and Alieta Eck started the Zarephath Health Center in Somerset, NJ as a means to see and provide care for those with limited income, are on Medicaid or have no insurance at all.

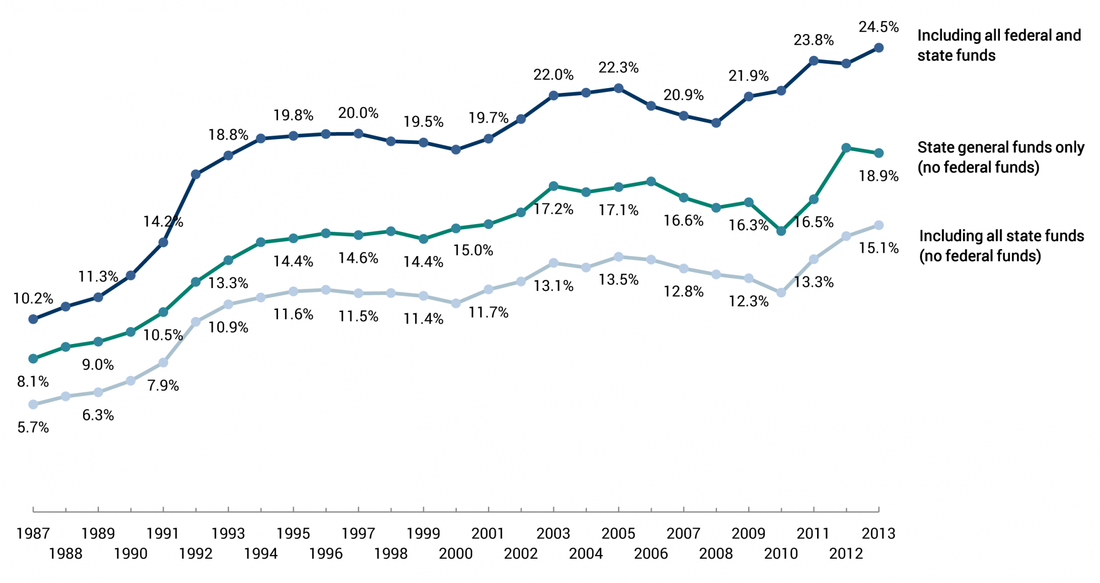

One significant attribute of the Eck's free clinic is that the Zarephath Health Center doesn't cost taxpayers a single dime. This is a key distinction considering that Medicaid's percentage of state and federal budgets has consistently gone up over the years while people seek to make the best use of the money they do have.

The rising costs of Medicaid always leads to state politicians restructuring how Medicaid is provided.

One significant attribute of the Eck's free clinic is that the Zarephath Health Center doesn't cost taxpayers a single dime. This is a key distinction considering that Medicaid's percentage of state and federal budgets has consistently gone up over the years while people seek to make the best use of the money they do have.

The rising costs of Medicaid always leads to state politicians restructuring how Medicaid is provided.

Here is an example on how Massachusetts has looked to make Medicaid more of a benefit to patients.

After going over Mass. Gov. Charlie Baker's plan you'll see he is not saving money for the taxpayers of Massachusetts at all when it comes to Medicaid. Instead, he is just shifting the process of how Medicaid is paid for. Reduced amount of payments early on and a heavier more expensive payment load in the future.

In attempt to help Medicaid patients have easier access to doctors, some states have decided to increase how much money a doctor receives to see Medicaid patients. (Increased taxpayer costs).

On the other hand, by using a system of charity the Zarephath Health Center can see up to 400 patients a month without a single penny coming from taxpayer money.

After going over Mass. Gov. Charlie Baker's plan you'll see he is not saving money for the taxpayers of Massachusetts at all when it comes to Medicaid. Instead, he is just shifting the process of how Medicaid is paid for. Reduced amount of payments early on and a heavier more expensive payment load in the future.

In attempt to help Medicaid patients have easier access to doctors, some states have decided to increase how much money a doctor receives to see Medicaid patients. (Increased taxpayer costs).

On the other hand, by using a system of charity the Zarephath Health Center can see up to 400 patients a month without a single penny coming from taxpayer money.

While state and federal budgets are key issues, a more important concern is how good the quality of care is a patient receives when you compare Medicaid with a facility like the Zarephath Health Center.

As was just stated, Dr. Alieta Eck's free clinic sees up to 400 patients a month. The purpose for her health center is to provide normal patient visits to as many people as possible that currently cannot pay for their own care. A lot of her patients still choose to see her even though they have Medicaid.

These patients know that a personal direct relationship with a doctor is much more valuable than having to wait a longer than average time for limited access to a doctor as is often the case with Medicaid patients. See here, here and here.

As was just stated, Dr. Alieta Eck's free clinic sees up to 400 patients a month. The purpose for her health center is to provide normal patient visits to as many people as possible that currently cannot pay for their own care. A lot of her patients still choose to see her even though they have Medicaid.

These patients know that a personal direct relationship with a doctor is much more valuable than having to wait a longer than average time for limited access to a doctor as is often the case with Medicaid patients. See here, here and here.

This is a charity that Dr. Alieta Eck and her husband Dr. John Eck is in control of.

They schedule appointments with patients accordingly to make sure each patient's needs and concerns are addressed. They don't have to worry about a government mandate that forces them to see patients that they cannot provide proper care towards.

Having such a mandate can be a detriment to the patient when they are trying to see a doctor that only has so many hours in a day to see as many patients as possible. The attention to quality and care suffers..

They schedule appointments with patients accordingly to make sure each patient's needs and concerns are addressed. They don't have to worry about a government mandate that forces them to see patients that they cannot provide proper care towards.

Having such a mandate can be a detriment to the patient when they are trying to see a doctor that only has so many hours in a day to see as many patients as possible. The attention to quality and care suffers..

Nice Story About a Local Town or Can Free Care Minus Government Funding Become Mainstream?

According to Dr. Alieta Eck, her research and communications with other doctors leads her to believe that what she does at the Zarephath Health Center can become standard protocol all across the country.

Dr. Eck mentions in a few interviews that there are many doctors who would love to provide time out of their weekly schedule to help provide free care to the poor. One hurdle that gets in their way is they are afraid of malpractice suits.

One solution that Dr. Eck believes will resolve this issue is why she 'is working to enact NJ S239 in New Jersey whereby physicians would donate their time caring for the poor and uninsured in non-government free clinics in exchange for the State providing medical malpractice protection within their private practices. She is convinced that this would relieve taxpayers of much of the Medicaid burden currently consuming 1/3 of the NJ budget.' (2)

Dr. Eck mentions in a few interviews that there are many doctors who would love to provide time out of their weekly schedule to help provide free care to the poor. One hurdle that gets in their way is they are afraid of malpractice suits.

One solution that Dr. Eck believes will resolve this issue is why she 'is working to enact NJ S239 in New Jersey whereby physicians would donate their time caring for the poor and uninsured in non-government free clinics in exchange for the State providing medical malpractice protection within their private practices. She is convinced that this would relieve taxpayers of much of the Medicaid burden currently consuming 1/3 of the NJ budget.' (2)

Charity to Pick People Up

What is appealing to me about how the Zarephath Health Center works is that this is an example of true charity in action. Hundreds of people that currently have limited means are still being helped via the skill and volunteerism of people who care.

It's entirely possible that as people receive true charity care they might have a better chance of improving their own life conditions. Dr. Alieta Eck has stated that some patients that use the Zarephath Health Center during tough times have gone on to find jobs or a better income and lifestyle for themselves and are now able to handle paying for their own care at traditional health facilities.

During this election season we will no doubt hear accusations and promises from politicians when it comes to our healthcare system.

Pay attention to what your favorite candidate says.

Are these politicians just reshuffling your taxes but still using more of your state's and federal budget? Or is there a better way to provide care to patients in need without creating an ever increasing burden on taxpayer funds?

The Zarephath Health Center has proven for over a decade that true charity free of taxpayer involvement can work.

-- Ricky Moore

It's entirely possible that as people receive true charity care they might have a better chance of improving their own life conditions. Dr. Alieta Eck has stated that some patients that use the Zarephath Health Center during tough times have gone on to find jobs or a better income and lifestyle for themselves and are now able to handle paying for their own care at traditional health facilities.

During this election season we will no doubt hear accusations and promises from politicians when it comes to our healthcare system.

Pay attention to what your favorite candidate says.

Are these politicians just reshuffling your taxes but still using more of your state's and federal budget? Or is there a better way to provide care to patients in need without creating an ever increasing burden on taxpayer funds?

The Zarephath Health Center has proven for over a decade that true charity free of taxpayer involvement can work.

-- Ricky Moore

Footnotes

(2) http://www.theconservativepundit.net/meet-the-pundits/dr-alieta-eck-md/

Regarding cases where malpractice issues come up:

'The exclusive remedy for injury or damage suffered as the result of any act or omission of the volunteer medical professional is by commencement of an action against the State in a court of competent jurisdiction.' -- In other words, patients should keep records of everything possible that is discussed in the event these records are needed to help prove their case in court.

While malpractice suits are unfortunate and do happen it shouldn't cast a shadow of not only the potential good that comes from charity care but the good that has already been experience by patients.

If the Zarephath Health Center sees up to 400 patients a month then we can be a little conservative and use 350 patients for my example. 350 patients a month adds up to 4,200 patients a year. Over the past 5 years would mean that up to over 20,000 patients have been seen and have had their needs addressed, again, without taxpayer money.

In my view this is a far more efficient system of healthcare than what we currently have in place for people with low incomes who are on medicaid.

Regarding cases where malpractice issues come up:

'The exclusive remedy for injury or damage suffered as the result of any act or omission of the volunteer medical professional is by commencement of an action against the State in a court of competent jurisdiction.' -- In other words, patients should keep records of everything possible that is discussed in the event these records are needed to help prove their case in court.

While malpractice suits are unfortunate and do happen it shouldn't cast a shadow of not only the potential good that comes from charity care but the good that has already been experience by patients.

If the Zarephath Health Center sees up to 400 patients a month then we can be a little conservative and use 350 patients for my example. 350 patients a month adds up to 4,200 patients a year. Over the past 5 years would mean that up to over 20,000 patients have been seen and have had their needs addressed, again, without taxpayer money.

In my view this is a far more efficient system of healthcare than what we currently have in place for people with low incomes who are on medicaid.

When describing how he felt compelled to provide high value/affordable care to patients, Dr. Josh Umbehr sums it up this way, 'I was young and dumb.'

He actually isn't dumb at all but was making a point that he had no interest in getting bogged down with the minutia of heavy paperwork, wasting time dealing with insurance companies that dictate the kind of care a patient receives and how they will pay for such care.

Dr. Umbehr, a family medicine physician, saw right from the start that there is a better way to provide meaningful care that his patients would appreciate. This is how he and his business partner, Doug Nunamaker, MD started Atlas.MD.

He actually isn't dumb at all but was making a point that he had no interest in getting bogged down with the minutia of heavy paperwork, wasting time dealing with insurance companies that dictate the kind of care a patient receives and how they will pay for such care.

Dr. Umbehr, a family medicine physician, saw right from the start that there is a better way to provide meaningful care that his patients would appreciate. This is how he and his business partner, Doug Nunamaker, MD started Atlas.MD.

Access to Your Doctor...Anytime

Dr. Umbehr believes the best way to be there for his patients is to have a close, direct relationship with them. Atlas.MD provides a membership fee plan that gives patients 24/7 access to go over their health concerns.

As Dr. Umbehr likes to describe, it's like comparing Netflix to Blockbuster. Whereas a customer had to travel to a Blockbuster to pay about $4 to $7 dollars for a couple of rentals at a time, Netflix forced a paradigm shift by offering 1,000's if not 10,000's of movies and shows instantly for under $8 a month.

As far as Atlas.MD patients are concerned, they can:

As Dr. Umbehr likes to describe, it's like comparing Netflix to Blockbuster. Whereas a customer had to travel to a Blockbuster to pay about $4 to $7 dollars for a couple of rentals at a time, Netflix forced a paradigm shift by offering 1,000's if not 10,000's of movies and shows instantly for under $8 a month.

As far as Atlas.MD patients are concerned, they can:

- Schedule unlimited office or home visits. (No Copay)

- Communicate with their doctor via text, phone, email, Facebook, Twitter etc.

- Receive prescribed medication at wholesale costs. Atlas.md owns their own pharmacy which allows them to pass dramatic savings to their patients.

- Receive diagnostic and procedural benefits at no extra costs. Including EKG, Holter Monitor, DEXA Scan, Body Fat Analysis, Spirometry, Breathing Treatments, Cryotherapy, Lesion Removal, Laceration Repair, just to name a few.

The above services and benefits are included with the patients monthly membership fee.

The first step in a patient taking control of their healthcare is deciding if the value that Atlas.MD provides is worth the monthly fee that they would agree to pay.

This is an example of how things should be in a free market healthcare system:

It is Atlas.MD's responsibility to fulfill the promises stated in their contract agreement with their patients.

Just like a consumer will stop going to a store that doesn't provide a good enough service, a patient is free to stop their membership at anytime if they believe their issues have not been addressed or if they have found better value from a healthcare facility elsewhere.

The patient has control of how they seek the care they need.

It appears Atlas.MD has provided great value to their patients. Membership count has gone from 0 to 1500 patients in about 3 years as of 2014. The growth in their practice, to a great degree can be attributed to more patients seeking ways to reduce their overall healthcare costs in the age of the Affordable Care Act.

Patients are attracted to knowing exactly what their money is paying for. Their membership brings more than just financial value.

Peace of mind and a sense of control brings added comfort as well. Reducing the stress involved in discussing their care as opposed to some Medicaid patients that become frustrated with the delays in getting their health issues resolved.

The first step in a patient taking control of their healthcare is deciding if the value that Atlas.MD provides is worth the monthly fee that they would agree to pay.

This is an example of how things should be in a free market healthcare system:

- The patient decides for themselves without interference from a third party.

It is Atlas.MD's responsibility to fulfill the promises stated in their contract agreement with their patients.

Just like a consumer will stop going to a store that doesn't provide a good enough service, a patient is free to stop their membership at anytime if they believe their issues have not been addressed or if they have found better value from a healthcare facility elsewhere.

The patient has control of how they seek the care they need.

- Direct communication with their Doctor as opposed to waiting in an office where they have to wait in line.

- Wholesale prescription costs that can save patients more money than their actual Atlas.MD monthly fee.

It appears Atlas.MD has provided great value to their patients. Membership count has gone from 0 to 1500 patients in about 3 years as of 2014. The growth in their practice, to a great degree can be attributed to more patients seeking ways to reduce their overall healthcare costs in the age of the Affordable Care Act.

Patients are attracted to knowing exactly what their money is paying for. Their membership brings more than just financial value.

Peace of mind and a sense of control brings added comfort as well. Reducing the stress involved in discussing their care as opposed to some Medicaid patients that become frustrated with the delays in getting their health issues resolved.