|

Have you ever noticed that the stock market seems to have a record high at least once a month? Meanwhile your day to day activities doesn't reflect the financial euphoria felt by Wall Street. Rising stock market values has less to do with the real world economy with each passing year. Instead, stock market values frequently rise as a result of Wall St techniques that can raise a company's stock price independently from what is actually going on in the economy. Besides Wall St. tricks, the Federal Reserve also has the ability to prop up the stock market during times when the economy can easily improve. Share Buy Back / Repurchasing Stocks One option a company will take to boost it's stock price is to repurchase it's own shares. Generally speaking, a company's bottom line is creating a profit and raising value for it's shareholders. Whether or not a company is satisfying consumer demand is not relevant when it comes to buying back their own stock. Here are a few things I consider when I think of a good economy:

These questions aren't answered when a company has just repurchased it's own stock to give the appearance of a higher stock value. Big Banks Buy Back Their Own Stocks Also  From the AP article shown above:

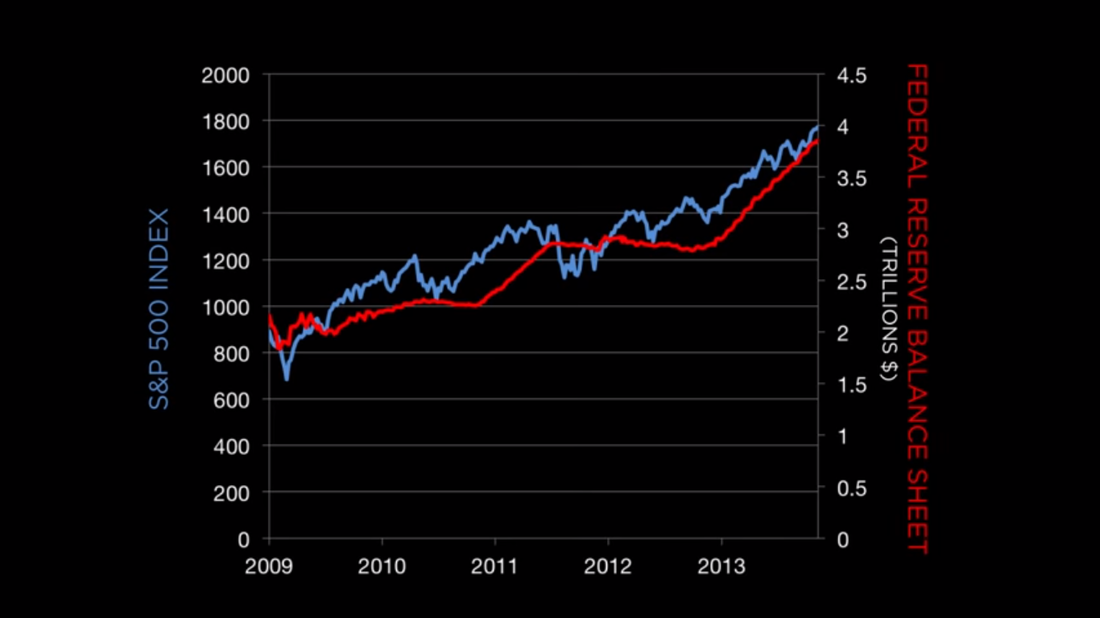

Bank of America, Citigroup and JP Morgan Chase bought back up to roughly $17 Billion in stock shares. That looks good for Wall St reports but doesn't change much for your typical everyday worker and saver. Stock buybacks are common and have increased in the past few years. Apple does it. (Excerpt) 'Although its growth rate is slowing, Apple generates huge amounts of free cash flow. This allows it to continue rewarding shareholders with increasing cash returns, including dividends and stock buybacks.' The TV station CBS does it. (Excerpt) 'The announcement comes as some analysts question whether the broadcaster can continue to show the kind of growth that fueled a nearly 15% growth in its stock price so far in 2016. For example, this month UBS Global Research’s Doug Mitchelson downgraded CBS to “sell,” saying he believes TV advertising will lose steam after the Olympics.' Home Depot seems to be experts at stock buy backs. (Excerpt) 'So, investors are piling into Home Depot thinking it's a safe place to ride out the recent market volatility. But ironically, they are paying a near-historic multiple for a stock that is being driven by stock buybacks -- financed by debt that will probably become more expensive later this month. Good luck with that.' I am not commenting on the efficacy of 'stock buybacks' as an investing strategy. Instead, I am making the observation that the financial media places too much importance on a company's stock quote when they claim the economy is strong and healthy. A company can raise it's stock market value regardless of whether or not they are meeting consumer demand or creating a profit from their day to day activities.  Investors used to pay more attention to real world economic and business signals, they use to put more emphasis on the details of a company's balance sheet before making investment decisions. Now, instead of real world data, investors wait to see what the Federal Reserve (America's Central Bank) will do. This NY Times article shows how Wall St. investors will slow down stock market activity until they find out if the Federal Reserve has changed policies regarding interest rates or the creation of new money into the market: 'John Canally, an investment strategist at LPL Financial, expects the market to coast until the Federal Reserve meets next week. "Basically, we're in a waiting period for the Fed," he said. "Today is probably what you can expect for the rest of the week: a lack of direction."' Definitely a lack of direction. Rather than looking at a business's ability to efficiently meet consumer demand, among other economic fundamentals. Investors now wait for the Federal Reserve to report if their 'easy money' policies will continue. 'Easy Money' policies are given fancy names like 'quantitative easing' but in reality it is just another debt scheme. Quantitative Easing Explained From Investopedia.com: Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. In normal language, the Federal Reserve purchases debt (bonds, mortgage backed securities, etc.) from financial institutions like big banks, when the Fed purchases this debt, new money is created as an asset into a bank's bottom line. The purpose of this new money is to allow the banks to lend more to everyday people looking for loans to start businesses or make important big purchases like buying a home. Quantitative Easing / Stock Market Parallel Looking at the graph above you notice there is a strong correlation between the growth in the S&P 500 Index and the trillions of dollars created by the Federal Reserve. Another example of rising stock market value that has nothing to do with the satisfaction of consumers buying products or businesses running efficiently. This kind of stock market growth is propped up by the Federal Reserve purchasing debt and placing trillions of dollars into big banks Of course many banks didn't increase their lending activity to consumers because the Federal Reserve paid them interest on the newly created money which gave banks a positive cash flow. For more on this issue read this Huffington Post article. If you invest in the stock market you would be wise to do as much of your own research as possible with the understanding that there is more information needed than just a company's stock price or what the Federal Reserve is doing.

Researching these kind of questions may help you manage the ups and downs of a stock market whose value is easily manipulated by other factors that has nothing with real productive growth. -- Ricky Moore

0 Comments

Today's current healthcare system in America can limit patients choices for care and blind them to true costs of service.

Instead of having piece of mind on the care they are receiving, many patients have to fight insurance companies about services, costs and innocent coding mistakes that hike up the prices that the patient has to pay. In addition patients over the years have gotten used to longer waits and shorter visits with their primary care doctor.

Fortunately there seems to be a growing trend of a more efficient model of patient care, at least in the world of family physician services. This model is referred to as Direct Primary Care.

What Direct Primary Care means is that you and your doctor have a clear, close working relationship with each other free of bureaucracy and 3rd party insurance interference. Health Suite 110: A Family Physician Practice that Works With Patients to Provide Excellent Care

Health Suite 110 is a family physician facility located in Kansas, co-founded by Dr. Kylie Vannaman and Dr. Haseeb Ahmed.

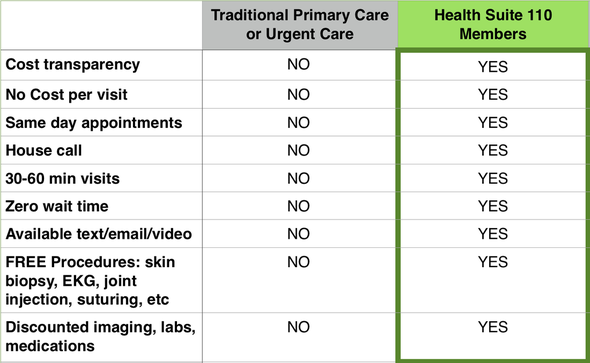

With independent practices in the same location, both Dr. Vannaman and Dr. Ahmed's focus is on making sure the patient is comfortable and does not feel rushed to discuss issues regarding their health. In our traditional healthcare system, many patients feel like they are on a conveyor belt being shuffled from one room to the next. Their ability to get the care they need is limited by what their insurance company is willing to cover. But if you were to remove the insurance company out of the equation then the doctor and patient can work toward a mutual understanding of the best road to take to maintain the best state of health possible. What facilities like Healthy Suite 110 prove is that insurance companies aren't needed for many general physician services. Their patients can substantially reduce their insurance premiums because many services (like those shown below) are already included with their monthly service fee. Health Suite 110 Patient Services

Simple and Direct

Patients that visit Health Suite 110 are essentially paying members of a club. It is the job of Dr. Ahmed and Dr. Vannaman to live up to the expectations of their members:

Is the Direct Primary Care Model Good for Me?

Everyone is different with their own set of unique circumstances. Here is some information to help you decide if Direct Primary Care is a good option for you, straight from the website of Health Suite 110 co-founder, Dr. Kylie Vannaman.

What you should ask yourself is:

Besides financial benefits, do you feel as if your doctor is in your corner and has your best health interests in mind? Do your research? A theme on my site is that an informed mind can more easily choose the most efficient and logical solution for themselves. Dr. Vannaman and Dr. Ahmed are examples of professionals that act on their convictions to provide a high quality of service to their patients. They are trying to remove obstacles away from the patient to receive the best care.

In today's healthcare climate of rising premiums, limited coverage and lack of price transparency, it is worth your time to see if a direct primary care facility can work for you.

With a proven track record of making the care of their patients their top priority, the doctors at Health Suite 110 will serve as a testament that clear communication and exceeding patients expectations is the norm and not the exception. Health Suite 110

Happy Fourth of July, exercise your freedom to be in control of your own health care!

Ricky Moore

Independent Asset Management Agent

In the near future I will have a list of direct primary care family physician facilities in as many states as possible.

|

BlogsObserving the Cause/Effect cycle of economic systems. Archives

November 2020

Categories |

RSS Feed

RSS Feed