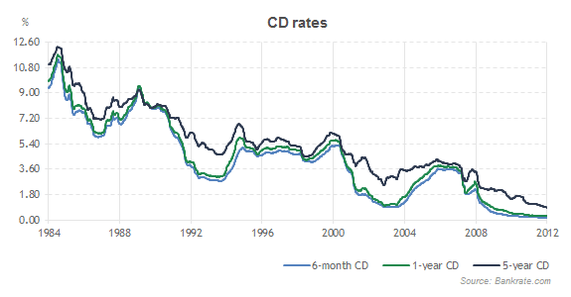

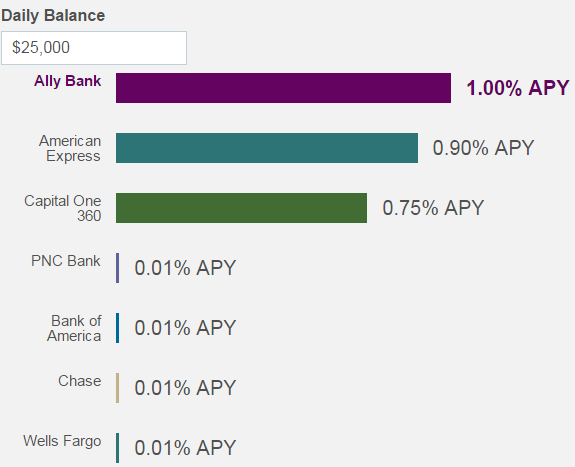

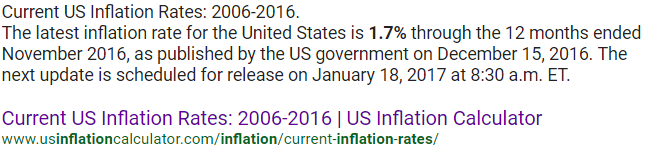

1. Low Interest Rates & Higher Inflation Rates = Bad ComboLow rates have been hurting savers for the past 8 years as this NY Times article published in 2010 points out: 'Because of persistent low interest rates, anyone looking for decent returns that are also safe has had a tough time this year. Most of the best savings accounts, for instance, don’t even top a 1.5 percent annual yield.' '...the earnings on your savings may not be keeping up with real-life inflation, the kind that includes rapidly increasing health care and other expenses that older people bear the most. And even if you aren’t paying higher prices, it’s still disappointing to earn so little on money you want to be there when you need it.''  The historical safe havens to watch your money grow such as savings and CD accounts have become irrelevant these past few years. CD rates now hover around 1 %, down drastically from the over 10% rates in the mid-1980's. While the popular Ally Savings bank shows how their low 1% savings rate is still better than the competition. Even people who have over $10,000 in low rated savings accounts are frustrated. Their savings, along with everybody else's barely keeps up with the inflation as recorded by the Bureau of Labor Statistics. Simple math will tell you that if your savings rate is lower than the official inflation rate then you are losing the purchasing power of your money. This is because the rate that your money is compounding interest is slower than the rate your money is losing value or slower than the rate of rising prices. How can a Single Premium Life Policy Help Me Fight Low Interest Rates and Inflation?I suggest to interested and potential clients that their single premium should be an amount that they know that they do not need for everyday living expenses. This amount can come from savings, IRA's, CD's, mutual funds, etc. Basically, any amount that doesn't hurt or lower the kind of lifestyle they are currently living. The following 3 examples offer a range of the cash benefit amounts one can expect to have with one of the companies I represent, Foresters Financial. 55 Year Old Non Smoking Female

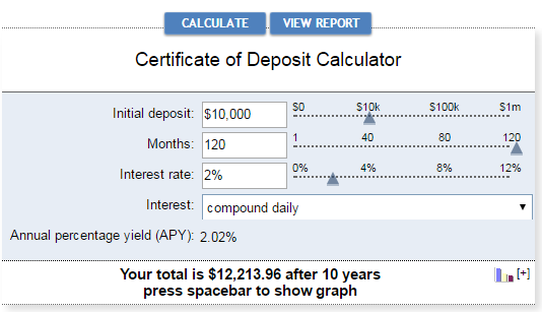

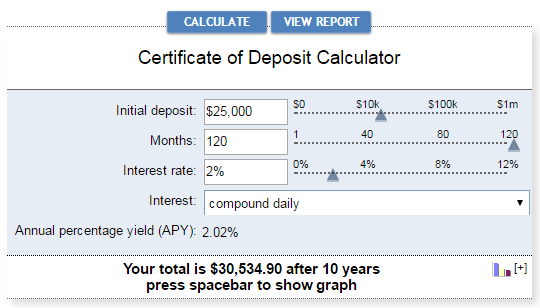

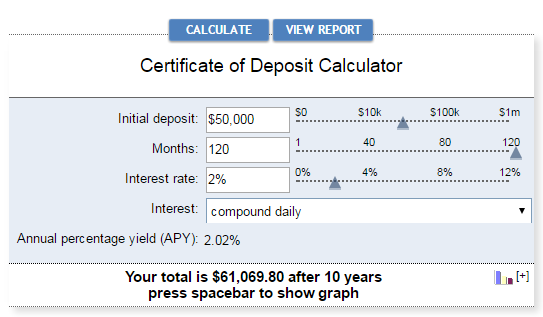

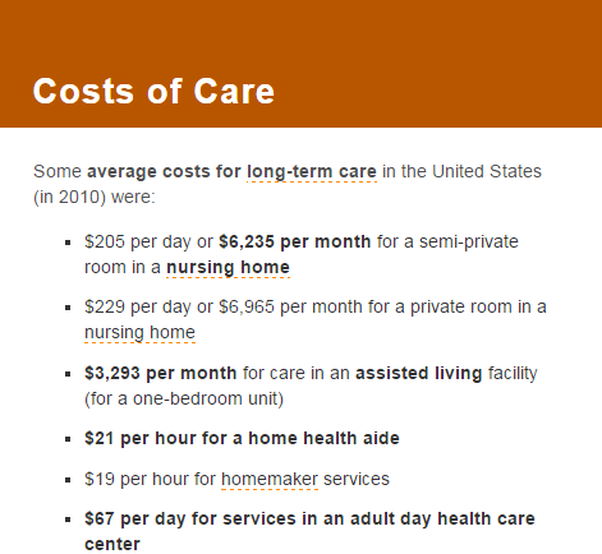

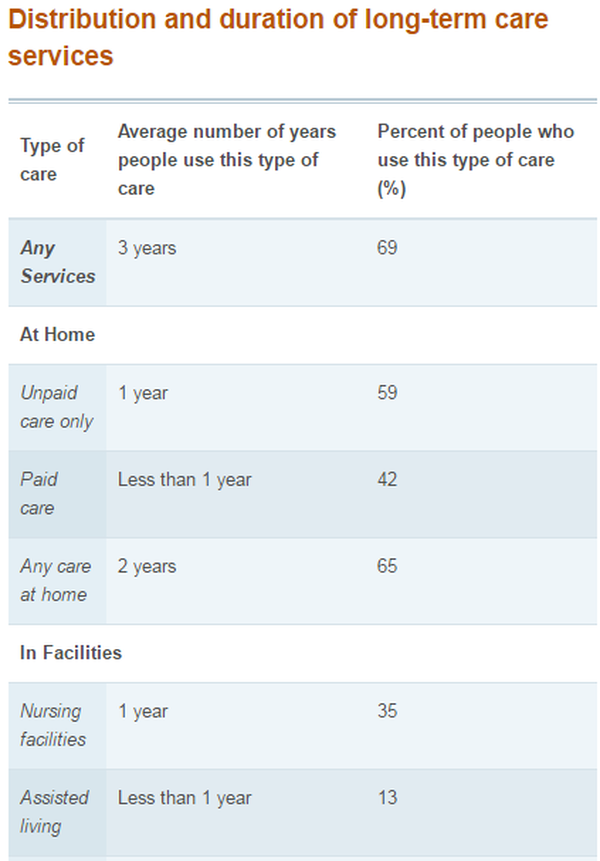

Here is how a CD (Certificate of Deposit) compares using the same single premium figures above. It would literally take decades for your CD to match the same cash value benefit as your single premium life policy. I used a 2% CD interest rate for this example which is higher than the average CD rate currently on the market. Your single premium cash benefit is available to use for emergencies such as critical and chronic illness needs such as long term medical care. If you never need long term medical care, your increased cash benefit can be taken out as a loan or left with your beneficiaries. Your one time premium will have gone much farther and have greater value for you and your family than if it was kept in a low interest rate that can barely keep up with inflation.  Robert Raymond Robert Raymond A very informative article from The San Diego Union Tribune covers how older couple couples have to deal with the sudden shock of needing long term care and the difficulties to pay for such care. Here is an excerpt from this article written by Michele Parente, highlighting Robert Raymond's situation: “We didn’t end up this way being careless, blowing all our money at the casino,” Robert said, sitting in a small studio apartment stacked with boxes filled with the couple’s possessions. “I’m sure I’m not unique in my age group of people getting old and getting wiped out.” In fact, the Raymonds’ financial downfall from middle-class retirees to destitute seniors is all too common. Long-term care, whether in the home, at an assisted living community or at a nursing home, is overwhelmingly paid out-of-pocket, from people’s savings. And multiple studies conducted in recent years all come to the same conclusion: America’s rapidly aging population is ill-prepared to pay for what’s coming. Most long term care isn't covered by Medicare and Medicaid only provides assistance until after you have already spent most of your savings. How can a Single Premium Life Policy Protect My Savings From Long Term Care Expenses?To better answer that question you should know the costs involved with Long Term Care expenses and exactly how long term care is defined: Long Term Care Definition from ElderLawAnswers.com --. Most long-term care involves assisting with basic personal needs rather than providing medical care. The long-term care community measures personal needs by looking at whether an individual requires help with six basic activities that most people do every day without assistance, called activities of daily living (ADLs). ADLs are important to understand because they are used to gauge an individual’s level of functioning, which in turn determines whether the individual qualifies for assistance like Medicaid or has triggered long-term care insurance coverage. The six ADLs are generally recognized as:

Most insurance companies have it written into policy contracts that benefits will be paid when the insured cannot perform at least 2 of the 6 ADLs. So back in 2010 staying in a nursing home for 12 months would cost you $74,820 on average. Staying in an assisted living facility (one bedroom) for 12 months could cost you $39,516. If we use the same single premium examples of the 55 year old non-smoking female (we'll call her Rosemary) from earlier then a $25,000 premium would be all she would need to handle a year in an assisted living facility. The benefit from Rosemary's $25,000 premium ($57,533) would cover the $39,516 assisted living costs and still leave her with a substantial amount to spare. If Rosemary needed to live in a nursing home for a year then the benefit from her $50,000 premium ($115,065) would cover the $74,820 expense with tens of thousands to spare. The extra savings would stay in Rosemary's policy and can be transferred to her beneficiaries income tax free. These are much better options than paying for care out of pocket with no financial protection. 3. Single Premium Life Policies Offers Better Tax AdvantagesYou already know that your savings and CD accounts are not giving you a substantial return of your money with low interest rates hovering around 1%. There is also the fact that interest earned on your savings and CD accounts is considered taxable income by the IRS. If you are in the 25 % tax bracket and your savings or CD earned $250, you will be taxed $62.50 from those earnings. CD's can be protected from tax penalties somewhat if they are placed within a tax deferred IRA. However in my opinion the tax advantages of a single premium life policy far outweigh those of an IRA. For Example: God forbid you are in a situation where you do need long term medical care, your single premium life policy benefits can be withdrawn to pay for your medical care without any tax penalties. If you never need long term care then your increased cash value benefit can be placed with your beneficiaries with no income tax penalties at all. Consider How Your Money Can Be Used to Value You and Your Family the Most...If you are an active real estate investor or you use your capital to invest in businesses that consistently gives you measurable profits then I can understand that a single premium life policy might not be the best choice to place your money. Even though it would still be a respectable option in those cases.

However, if you spent all of your working life placing money aside to save and you are not happy with the returns your savings account has given you then I suggest you send me an email or call me to go over the benefits of a single premium life policy in more detail to see if it fits your individual needs. If you like the concept of everything described in this article but would prefer to make smaller monthly or annual premiums then I would be happy to discuss those options for you as well. To your physical, mental, spiritual and financial well being, Ricky Moore 240-644-4376 info@healthyassets.org

0 Comments

Leave a Reply. |

BlogsObserving the Cause/Effect cycle of economic systems. Archives

November 2020

Categories |

RSS Feed

RSS Feed